Realising your dreams - or paying for emergencies – is possible with a cash boost of up to R300,000. Our trusted partner, Sanlam, offers personalised interest rates, affordable instalments, and up to 72 months’ repayment terms.

Overview

Whether you are facing a car repair crisis, unexpected medical bills, or a student loan limit, a personal loan can give you a quick cash injection at a customised interest rate. Based on an affordability assessment, and your credit score, we offer instant feedback when you apply for a loan of up to R300,000.

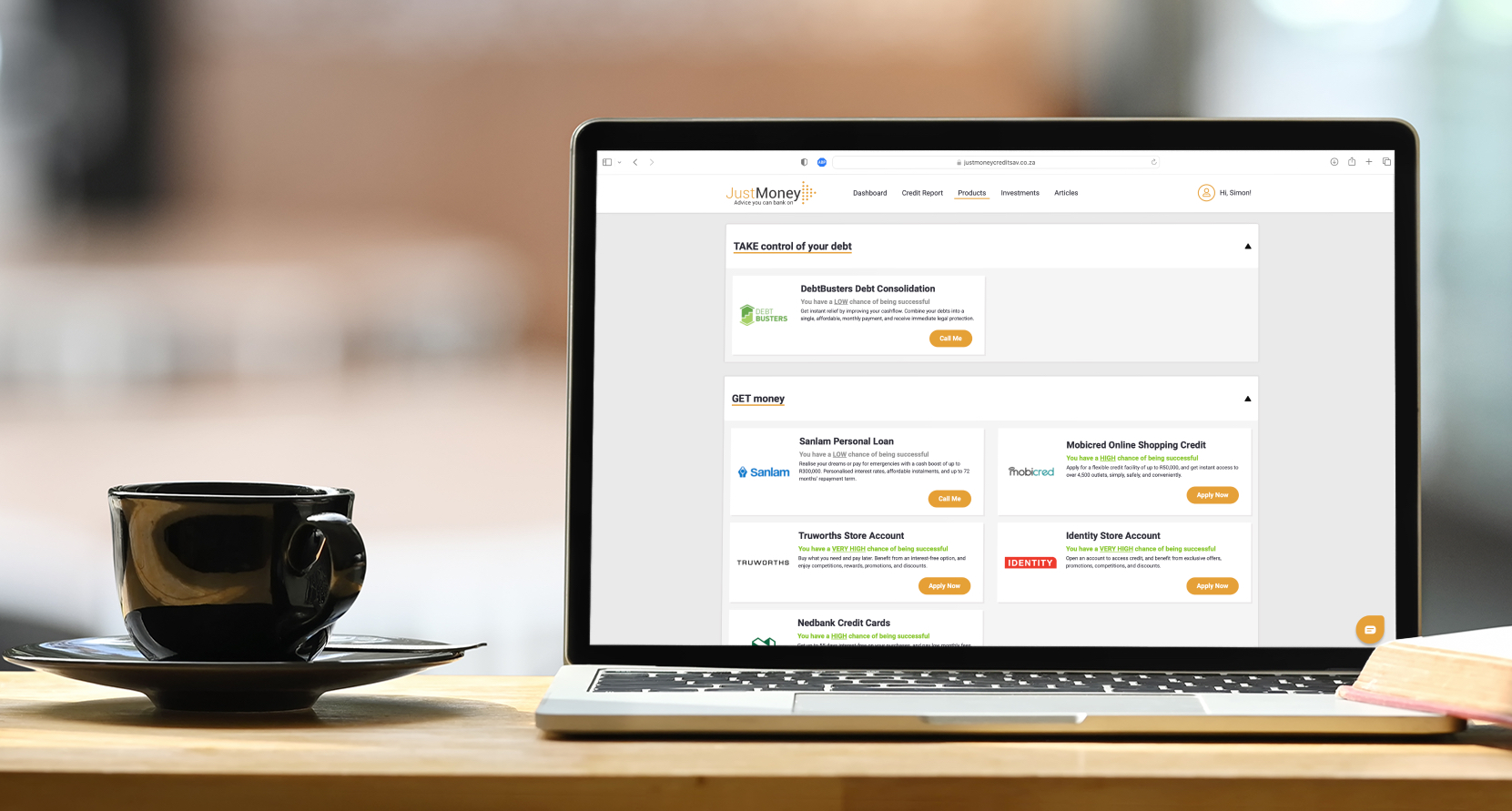

Log in to JustMoney now, visit the Products tab, navigate to GET money and click the View Offer button to see your FREE personal loan quote.

You can also apply for online shopping credit with Mobicred, Truworths and Identity store accounts, and a Nedbank credit card.

Quick guide to personal loans

Educational expenses

When used for good debt, such as a tertiary education, a personal loan can be a means of improving your earning capacity. We outline some pointers for those who are considering a personal loan.

Debt consolidation

If you’re struggling to meet your monthly debt repayments, a consolidation loan could be the answer you need. We consider what to ask before signing up for one of these.

Medical bills

Even with an emergency fund and adequate insurance, you may still land up with unexpected medical expenses. Chosen correctly, a personal loan could be among your better options.

Home renovations or repairs

Home renovations can greatly increase the value of your property. We consider whether, and when, a personal loan would be viable for funding these.

Funeral costs

Planning for the day a loved one dies can be difficult and emotive. Funeral cover pays out on the death of the insured, but the amount may not be sufficient to cover all expenses. A personal loan can help to bridge the shortfall, when considered carefully.

Unexpected expenses

It’s not wise to go into debt for luxuries or unnecessary expenses. Make sure you know the difference between good and bad debt before you take out a personal loan.

Articles and insights

How to find the best personal loan for you

2 April 2023 · Helen Ueckermann

Personal loans are not created equal, and the loan amount, while important, is not the only criterion you should consider.

Is a personal loan a wise way to cover medical expenses?

17 July 2022 · Fiona Zerbst

Healthcare is becoming increasingly expensive in South Africa. We consider whether a personal loan can be used to cover shortfalls.

Why take out a personal loan?

14 July 2022 · Carlene Gardiner

We consider three ways in which personal loans can be used to your benefit, and whether this form of credit is something you should pursue.

Can you afford the loan you qualify for?

13 April 2022 · Staff Writer

You’ve applied for a loan, and you find that you qualify – but can you afford it? The distinction may not have occurred to you, but it’s important to consider it before putting pen to paper.

Know the difference between a loan and a credit facility

7 November 2021 · Athenkosi Sawutana

Credit options can be separated into loans and credit facilities. We asked about the differences between them.

What are the interest rates on store accounts?

25 October 2021 · Staff Writer

Opening a store account is one of the easiest ways to build your credit score. Not surprisingly, a recent report by the National Credit Regulator (NCR) found store accounts to be among the most popular credit types for South African consumers - ...

How to fund a prototype for your start-up

21 October 2021 · Harper Banks

It’s quite an adventure to quit your job start your own business. But this decision also comes with a lot of risk. If the concept is new, it’s best to design a prototype before you jump into the deep end.

Is it worth the penalty to settle your personal loan early?

28 September 2021 · Harper Banks

If you have a personal loan, and you just received a bonus or an inheritance, you may be considering settling your loan in one go. However, did you know that this comes with penalties?

Are personal loans tax-deductible?

15 August 2021 · Harper Banks

If you belong to a medical aid scheme or you have a retirement fund, you can claim back a portion of your contributions from your annual taxes because these products are tax deductible.

Videos and podcasts you may enjoy

What does Credit Wellness mean to you?

Credit wellness is an important indicator of your financial health and journey. We chatted to a few people about their understanding of credit wellness.

31 Top tips to financially survive the silly season

Financially surviving the silly season isn’t always the easiest task, but this year we have you covered. With 31 tips that stretch from budgeting to becoming debt-free, we are here to help ensure that you stay on track.

What scares you about your finances?

Finances can be anxiety-inducing. If money matters keep you up at night or make your brow sweat, know that you are not alone. We spoke to readers about their fears.

Apply now

Make good money choices with a personal loan. Log in and view your personalised quote for FREE. Up to R300,000 available.