Access intelligent products and services, browse informative financial content, use money-savvy tools, join the JustMoney community, and be rewarded!

Access intelligent products and services, browse informative financial content, use money-savvy tools, join the JustMoney community, and be rewarded!

18 April 2024 · Helen Ueckermann

What can new parents expect to pay for bringing a baby into the world, if choosing to go the private medical route? We outline important considerations, and indicate costs.

16 April 2024 · Sylvia Walker

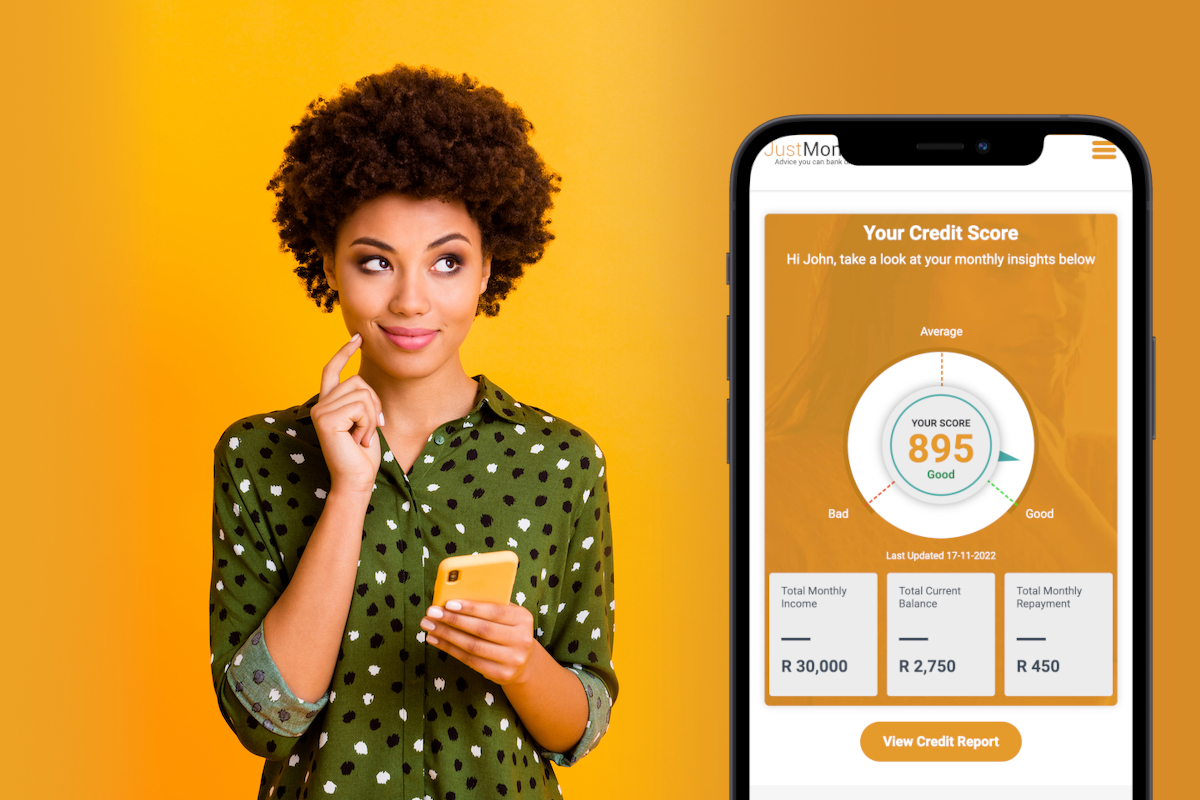

Tracking your credit score is essential. We find out what it entails, how it can benefit your finances, and what to do if you spot an irregularity.

11 April 2024 · Martin Hesse

Debt collectors don’t rate highly in the public popularity stakes – often, with good reason. We outline what debt collectors may not do.

9 April 2024 · Sylvia Walker

Black tax – the tradition of financially supporting family – can erode your financial security. We consider when, and how much, you should pay.

4 April 2024 · Fiona Zerbst

“Good debt” can help you to build your future wealth, but “bad debt” can do the opposite. We outline the differences to help you make smart choices.

2 April 2024 · Fiona Zerbst

As financial priorities shift, many people – particularly younger consumers – are reconsidering insurance. We investigate alternative ways to manage your risk.

With a track record of 16 years, JustMoney offers you FREE, quick, and easy access to financial products tailored to your needs. Whether you aim to save, invest, get credit, rehabilitate your finances, insure your assets, or monitor your financial health, we’ve got the tools to help you make good money choices.

We’ve hand-selected the most value-laden partners to bring you products and services that will build your financial health.

Register and access financial products and services tailored to your financial needs.

info@justmoney.co.za

5th Floor, 11 Adderley Street, Cape Town, 8001

© Copyright 2009 - 2024

Terms & Conditions

·

Privacy Policy

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.