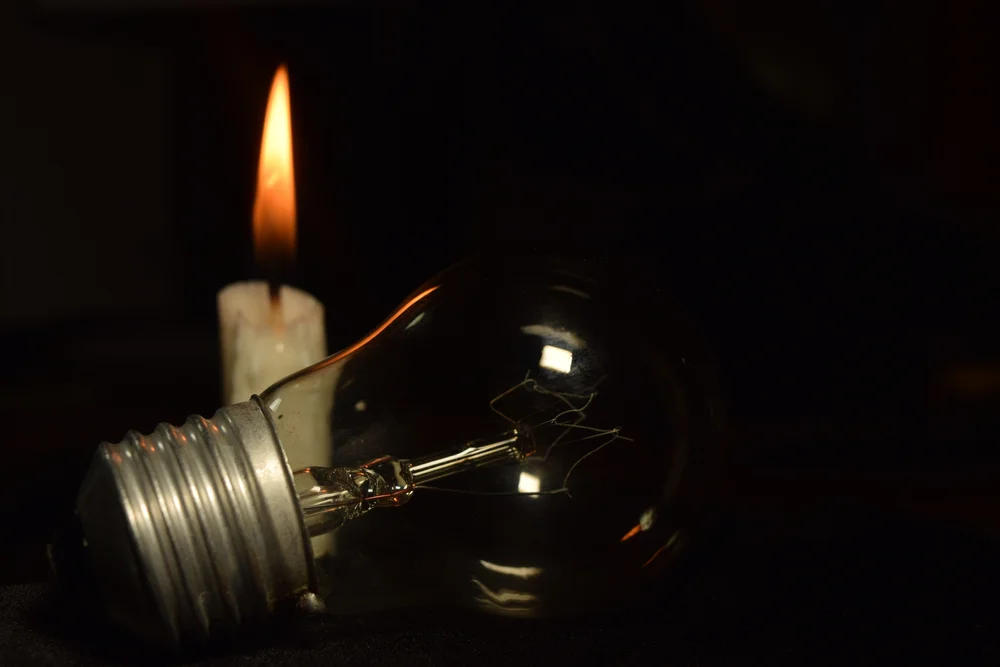

Load shedding is expected to worsen during the winter months, with stage six upwards likely to be in play. Power surges will be inevitable, putting household appliances and devices at risk of damage. For this reason, it pays to have adequate household insurance.

We investigate what insurers will and won’t cover in the event of damage due to a power surge, and the proactive steps you can take to prevent damage to your belongings.

Tip: Open an investment account to save for power-related upgrades, such as having surge protection added to your distribution board.

What is a power surge?

Short-term insurance broker Biagio Cicione explains that a power surge occurs when excess voltage “steams through electricity cables”, in the event of a power outage, followed by restoration.

The result is a “boost” in the overall electrical charge coming from the wall socket. The surge is fast and short, and it can result in damage to goods connected to the electricity circuit, says Cicione. If the circuit of an electronic item is damaged in this way, it can potentially start a fire.

The impact of insurance claims

It’s often uneconomical to repair items damaged during a power surge, says Natasha Kawulesar, chief client relations officer at OUTsurance; and this results in clients claiming from their insurers. While these claims need to be honoured, Kawulesar notes, there are consequences for insurance policyholders.

“Insurers have been overwhelmed by a large number of such claims, and have had to put some conditions in place to maintain affordable cover for clients,” she explains.

This may include requiring that surge protection equipment be installed; either at plug points, or at the main distribution board, notes Cicione.

Other insurers are charging a higher excess to manage claims.

“Momentum, for example, is charging R3,000 excess per claim,” notes Michelle Norton, an independent short-term broker at Stepp Insurance Brokers. “Further, the maximum amount payable is limited to R10,000 for any one event. However, clients can protect themselves by extending their power surge cover.”

What is and isn’t covered

Cicione says household fixtures such as air conditioning, gate motors, electric fencing, and alarm systems are normally covered under building insurance. Surge-related damage to these items can be claimed, up to any limit that the policy schedule stipulates.

Movable items, however, such as televisions, fridges, microwaves, and computers are normally covered under household contents, and they will not be insured if they stop working due to wear and tear.

Further, most insurers have recently adopted a grid failure exclusion. This means that, if the grid is unable to supply electricity for an unspecified period due to collapse, you will not be covered. Cicione notes that it’s important to understand the difference between grid or supply failure, and normal power surge events.

He also advises familiarising yourself with your policy schedule, excess structure, and policy conditions and limits.

“If you find anything difficult to understand, ask your broker or insurer to clarify so you know what you’re covered for,” he says. “Also remember that insurers are continuously implementing new limits and exclusions, so be on the lookout for the latest communications to this effect.”

Tips to protect yourself

Soul Abraham, chief executive for retail at Old Mutual Insure, recommends taking proactive steps to prevent power surge damage.

“Turn off electronics during load shedding, unplug non-essential devices during storms, and keep electronics away from sources of heat and moisture,” he recommends.

Christelle Colman, CEO of Ami Underwriting Managers, recommends installing adequate power surge protection. Not only will this reduce the impact of load shedding on your appliances and electronics, she says, but it will enable you to gain access to comprehensive insurance coverage, and reduced excess payments.

“Make sure all devices are properly grounded, well-maintained, and free of dust; and check wiring regularly to ensure optimal condition,” she adds.

Norton points to the importance of professional installation of distribution board surge protection units. There has been a recent increase in clients attempting to install these themselves, along with inverters and solar panels.

“In some cases, batteries have exploded, making fire a very real risk,” she says. “Be sure to use registered electricians and solar system companies, to avoid having insurance claims rejected.”

Tip: Debt can compromise your finances and prevent you from responding adequately to emergencies. Find out how to consolidate your debt.