Saving for your retirement is important but what happens when you draw your retirement income from the various products you’ve invested in? Does tax apply? We take a look into whether or not your retirement income is indeed taxed.

Tip: Click here to see your credit score.

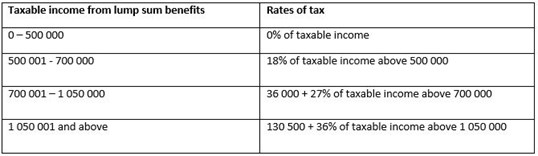

The short answer is yes. “You will be subject to tax based on the withdrawal/retirement lump sum tables which ranges between 0% and 36% depending on the amount withdrawn. There are threshold amounts depending on whether the withdrawal takes place before or after retirement,” explained Marc Sevitz director and chief financial officer of TaxTim.

Paul Slack from Fasttrac adds, “If you’ve contributed to a pension fund or retirement annuity, you have had a tax deduction along the way, so the monthly proceeds are taxable at normal PAYE (pay as you earn) rates. If your contribution was to a provident fund, then you had no tax breaks along the way (i.e. you paid from funds that had already been taxed) and the proceeds are tax free. The treatment of any lump sum from a retirement fund is (a) first R500k is tax free; (b) R500k to R700k is taxed at 18%; (c) R700kto R1050k is taxed at 27% and (d) anything over R1050k is taxed at 36%.”

A lump sum equal to a maximum of one-third of the retirement interest in that fund is the usual withdrawal, unless the entire value of the fund does not exceed R247 500 in which case you may take the full retirement interest as a lump sum, the South African Revenue Services (SARS) details.

The lump sum portion of the retirement interest is taxed using special tax rates upon retirement, as indicated below:

“It is important to note that all lump sums received from a retirement fund, whether as a result of retirement or not (and from an employer in respect of a severance benefit) are taxed on a cumulative basis. The significant impact of this is that, when the member eventually retires, the total value of all the lump sum benefits received by the member after 1 October 2007, will be taken into account when calculating the tax payable on the member's current retirement fund lump sum benefit,” noted SARS.

As indicated above, the two thirds of the retirement interest in respect of pension, pension preservation or retirement annuity is received in the form of an annuity, explained Will Keevy from Insurance Busters. “If the income from your annuity exceeds the tax threshold, tax is payable on the amount,” SARS iterated.

The tax thresholds, according to SARS, is as follows:

- For the 1 March 2017 to 28 February 2018 year of assessment for the tax season starting during 2018:

- Person below 65 – R75 750 per annum

- Person 65 and above but not yet 75 – R117 300

- Person 75 and above – R131 150.

- For the 1 March 2016 to 28 February 2017 year of assessment for the tax season starting 1 July 2017:

- Person below 65 – R75 000 per annum

- Person 65 and above but not yet 75 – R116 150

- Person 75 and above – R129 850.

- For the 1 March 2015 to 29 February 2016 year of assessment for the tax season that started 1 July 2016:

- Person below 65 – R73 650 per annum

- Person 65 and above but not yet 75 – R114 800

- Person 75 and above – R128 500

“It is important to note that, taking the above factors into account, even if you are no longer working, but are in receipt of annuity income, you might still continue paying tax. Each year you will have to declare your income from your annuity and any other income (e.g. investments income) you may have on your tax return (ITR12),” Sars added.

The unfortunate reality is that many people are in the dark about their retirement savings. “They rely on the advice of many people, many who are not qualified to give such advice,” stated Slack.

Most people hand over their retirement affairs to an advisor, which is a good decision, highlighted Sevitz. “However it is best to always ask questions and be informed as to what the status of the retirement investment is and update their advisor of any changes that could affect this investment so that there are no problems with the amount needed for retirement one day.”

At the end of the day, starting early enough and sticking to a savings plan means you can retire at the same standard of living you had immediately prior to retirement. But more importantly it is vital that you stay abreast of your investment portfolios, so you are well prepared.