It’s easy to ignore your credit card statements, or to fail to scrutinise them. However, understanding your credit card statement can be financially empowering.

We offer some expert insights on important items and information on your credit card statement, and consider how to apply this knowledge to improve your financial wellbeing.

Tip: How you manage your credit card repayments affects your credit health. Log in or register to view your credit score.

Monitor your credit

Understanding your credit card statement helps you monitor your credit limit and ensure you have sufficient credit available when you need it.

“It’s very embarrassing to have a transaction declined at a till point because you’re unaware that you have ‘maxed out’ your credit card,” says Sibongiseni Ngundze, group executive of consumer banking at African Bank.

“If you’re a customer using [African Bank’s] 62-day interest-free feature, you should also check that you’re not being charged interest for your purchases if you’ve settled the entire balance by your instalment due date,” Ngundze advises.

Read your statements monthly to keep track of your balance, subscriptions, and purchases, and to monitor the account for any erroneous or fraudulent transaction charges, or mistakes, he adds.

“Failing to read your statements may expose you to more credit card debt than you’ve budgeted for. It’s also important to carefully read your statement to spot unauthorised charges or billing errors,” says Ngundze.

Review your transactions

To avoid losing track of your spending on credit, schedule a day every month to review your monthly credit card statement, suggests Ngundze.

He advises that you take the following steps:

- Carefully read through all your transactions and ensure they reconcile with your purchases in the last month.

- Highlight the transactions you cannot reconcile.

- Query the highlighted transactions with the merchant, and request a correction or cancellation where required – for example, if a transaction was debited twice.

- If a dispute arises between you and the merchant, contact your bank via the contact centre or the email address supplied on the statement for assistance in raising a dispute.

- In case of a dispute, complete the relevant documents provided to you, and wait for the outcome.

Check each item on your statement

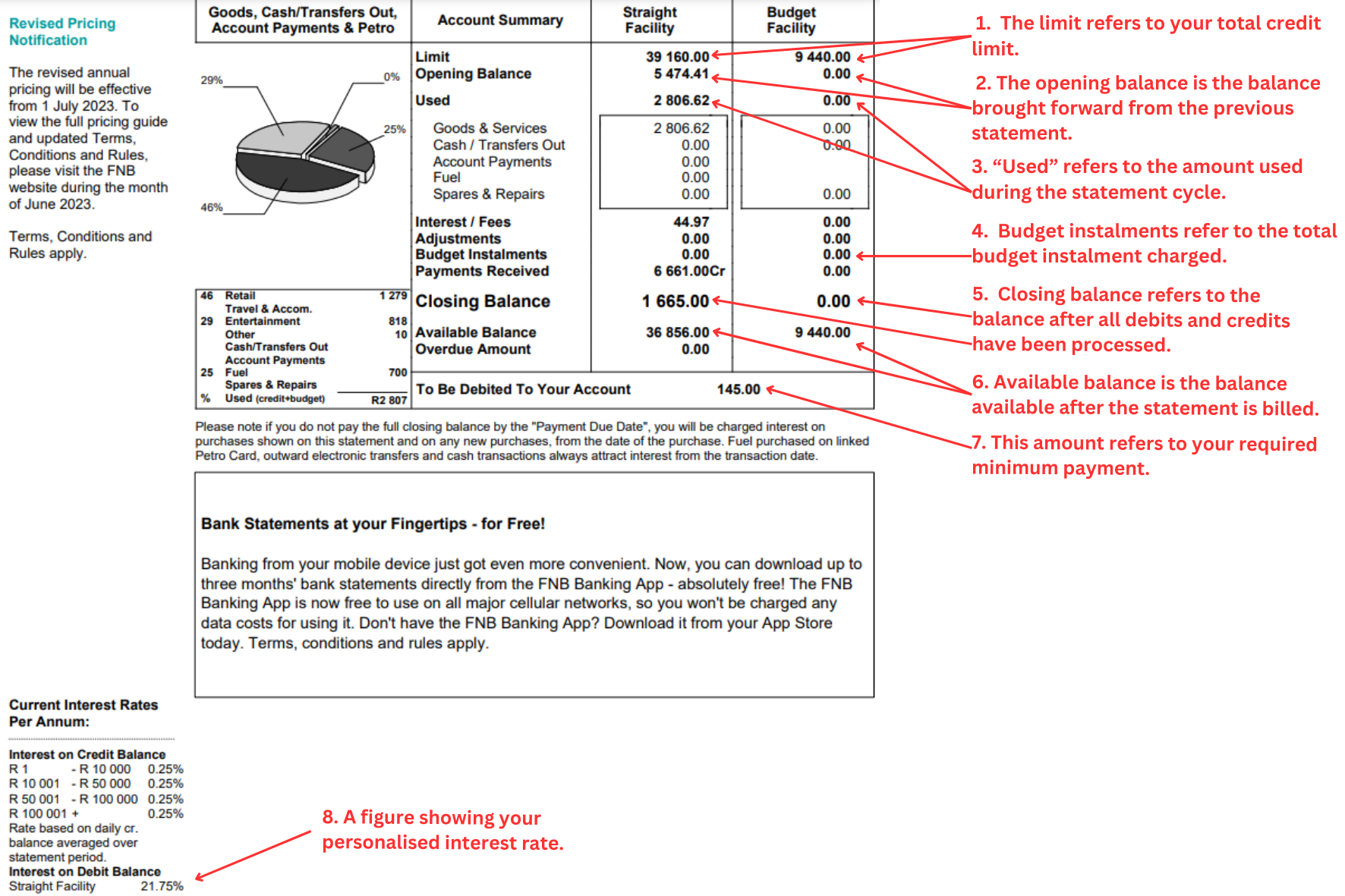

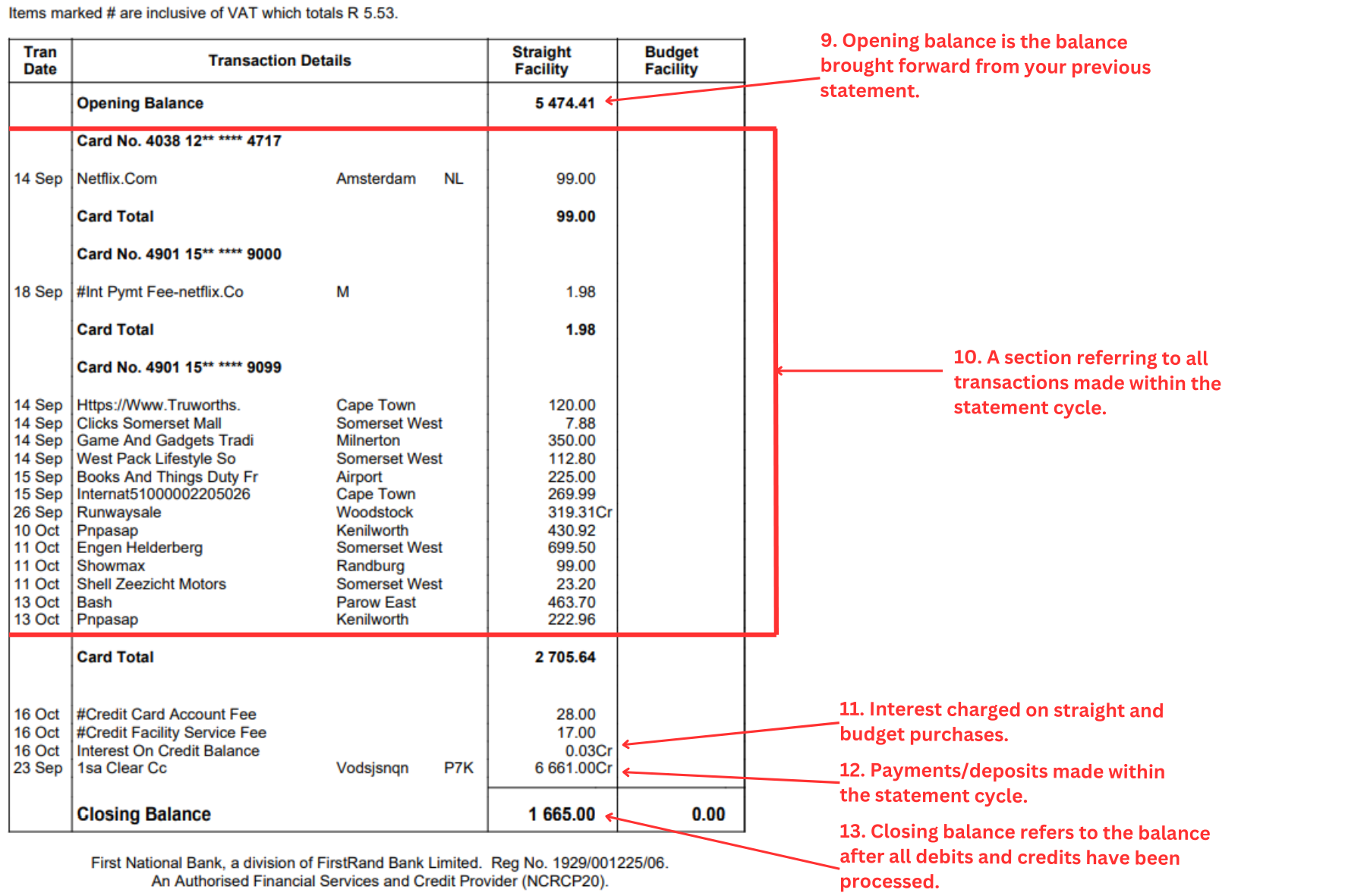

By way of example, the following is a credit card statement supplied by FNB. It includes terminology that makes it easy to understand the various components.

The highlighted items are of particular importance. These are explained below.

Once you have familiarised yourself with the above terms, and understand how they apply to your account, you’ll have a clearer idea of how to use your credit card statement to manage your spending and repayments.

Identifying and promptly reporting incorrect charges will limit your liability to your bank, Ngundze emphasises.

“Report errors, or query specific charges, via email or telephone using the information provided on your credit card statement,” he recommends.

Tip: Are rising interest rates putting the squeeze on your finances? Debt consolidation may be a solution.