View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, reap rewards for making good money choices, and receive unlimited access to a coach – all for FREE with JustMoney.

Overview

To be eligible for financial products, good credit health and an optimal credit score are essential. It’s crucial to ensure your creditworthiness by monitoring your credit report, and taking measures to enhance your credit score.

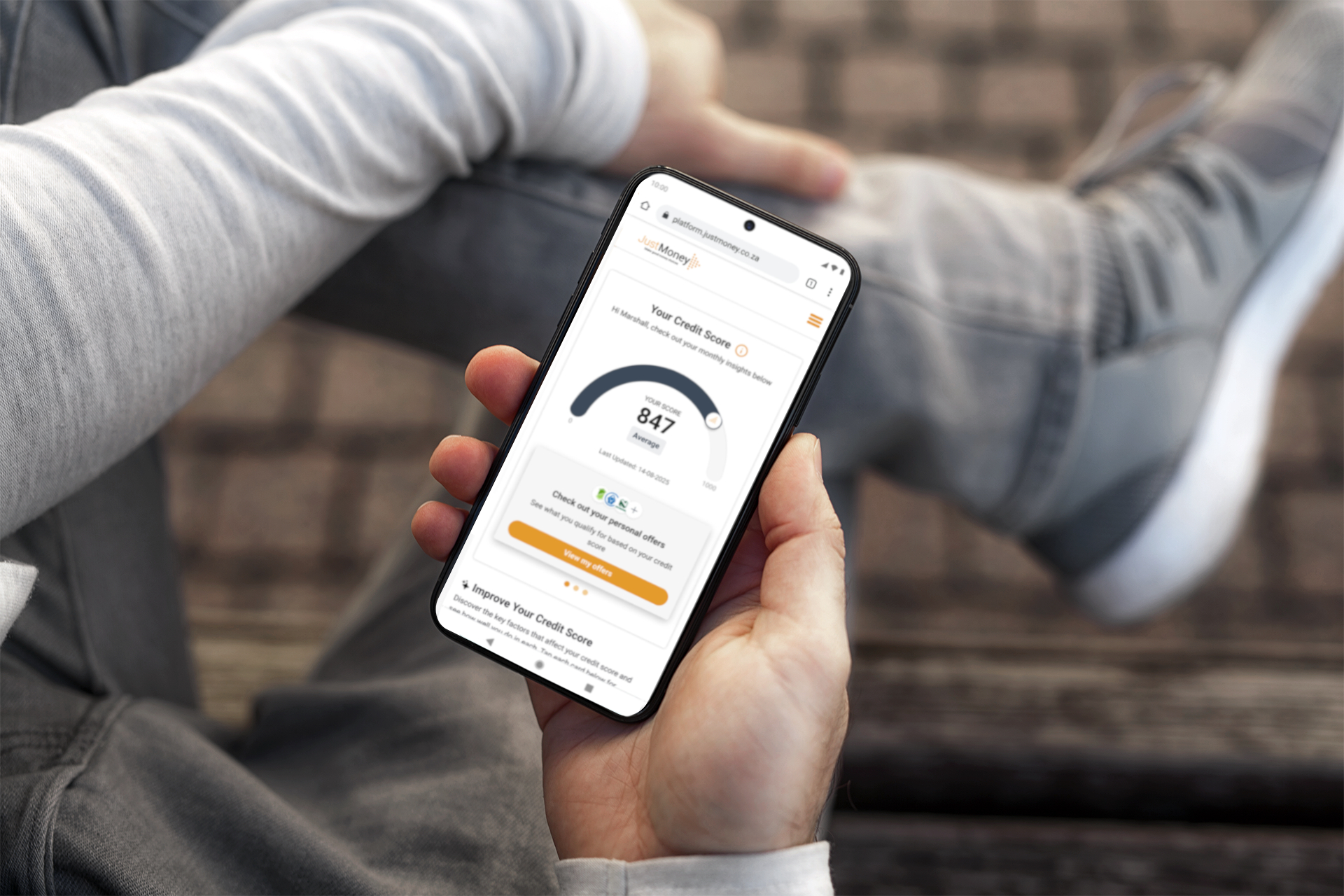

When you sign up with JustMoney, you’ll unlock valuable resources, including a credit report and a user-friendly credit dashboard.

Your credit score will be presented on a scale from bad to average to good, ranging from 1 to 1,000. Remember, your financial choices significantly affect your credit rating.

What people say

Key features of the JustMoney platform

Track your credit score history

The JustMoney platform allows you to monitor changes in your credit score over time, so you can keep a close eye on your credit performance, and track any improvements or declines.

Check your debt balance

Stay informed about your outstanding debts by easily checking your balances. This helps you keep tabs on your financial obligations.

See your personalised financial product offers

Gain access to a list of financial products tailored to your credit profile. The JustMoney platform provides personalised recommendations, making it easier for you to choose the financial products that best suit your needs.

View your accounts

The platform allows you to view all of your credit accounts in one place, providing a clear and organised overview.

Check your debt-to-income ratio

Evaluate your financial health by assessing your debt-to-income ratio. This ratio helps you gauge your debt level relative to your income.

Get unlimited access to coaches

Enjoy continuous support from dedicated financial coaches via the JustMoney platform. Whether you need guidance on improving your credit score, or choosing the best financial product for your needs, our coaches ensure you have expert assistance when you need it.

Get an instant quote for a personal loan

Explore your borrowing options by obtaining an immediate quote for a personal loan, based on your credit profile. The JustMoney platform simplifies the process of securing the right loan to help you reach your financial goals.

Get an instant quote for a debt solution

If you’re struggling to meet your credit obligations, the JustMoney platform provides a quick and convenient way to receive instant quotes for debt relief solutions. This feature helps you explore effective ways to manage and reduce your debts.

Articles and insights

Our articles provide valuable tips, strategies, and expert guidance to help you understand, improve, and maintain a healthy credit profile.

Whether you’re looking to boost your credit score, manage debt effectively, or navigate the intricacies of credit management, our articles empower you with the knowledge you need to make informed financial decisions.

Explore our wealth of resources, and stay on the path to a brighter financial future.

How to raise a dispute with a credit bureau

7 March 2023 · Fiona Zerbst

Incorrect information may appear in your credit report – and you have a right to challenge it. We discuss how to raise a dispute with a credit bureau.

How to avoid hitting your credit limit

7 February 2023 · Fiona Zerbst

Credit is a useful tool, provided you use it responsibly. We consider how credit limits are calculated, and how to manage your credit to stick within your budget.

How to access credit for the first time

2 January 2023 · Fiona Zerbst

This article outlines ways to access credit products in the absence of a credit score, and notes which products are best suited to first-time credit users.

Will your credit score help you to buy a property?

18 December 2022 · Fiona Zerbst

Your credit score is a key determinant of your home loan eligibility. We consider what your credit score reveals, and provide tips to help you secure a mortgage.

How lenders view your credit score, and how you can improve it

15 December 2022 · Fiona Zerbst

Your credit score is not just a number. This article explains how lenders and credit bureaus view your credit score, and provides some tips for improving it.

Is your credit score high enough to access vehicle finance?

8 December 2022 · Fiona Zerbst

We consider the role your credit score plays when you apply for vehicle finance, and note ways to improve your score so you can buy a car.

How to break poor credit habits

1 November 2022 · Fiona Zerbst

We investigate how poor credit habits can impact your financial health, and we consider what you can do to break them

How to improve your credit score

27 September 2022 · Fiona Zerbst

Lenders use your credit score to assess how risky it would be to lend you money. This article explains the steps you can take to improve your credit score over time.

Videos and podcasts you may enjoy

We’ve created a collection of informative and insightful videos that cover a wide range of topics related to financial wellbeing.

Whether you’re a visual learner or prefer the convenience of watching and listening, our video content is designed to provide you with valuable tips, expert advice, and practical strategies to help you master the art of credit management.

Join us on this visual journey to enhance your financial literacy and make informed decisions that lead to a healthier credit future.

What does credit wellness mean to you?

Credit wellness is an important indicator of your financial health and journey. We chatted to a few people about their understanding of credit wellness.

Put your financial savviness to the test

The JustMoney team celebrates women and their financial savviness. See how you would fare in certain financial situations, give this video a watch.

Honey, let’s chat money

Financial compatibility is important when choosing a partner. According to statistics, the majority of divorces are as a result of financial disagreements. At JustMoney we believe in laying a solid financial foundation. This process starts with ...

Get my credit score

Check your credit score and make good money choices. It’s instant and FREE! By registering with JustMoney, you will gain access to your free credit report and credit dashboard.