Insurance is a vital part of giving you peace of mind, so you can live with confidence. JustMoney helps you understand and compare credit life cover, home and car insurance, and more.

Find the right insurance for you

It can be complicated to determine what insurance you need — credit life, home and car, disability, and medical gap, to name a few! — and decide which products are best for your needs. JustMoney is here to help. With our broad range of articles covering all different topics related to insurance, you can equip yourself with the knowledge that you need to protect what matters most to you.

Articles and insights

The cost of giving birth in a private medical setting

18 April 2024 · Helen Ueckermann

What can new parents expect to pay for bringing a baby into the world, if choosing to go the private medical route? We outline important considerations, and indicate costs.

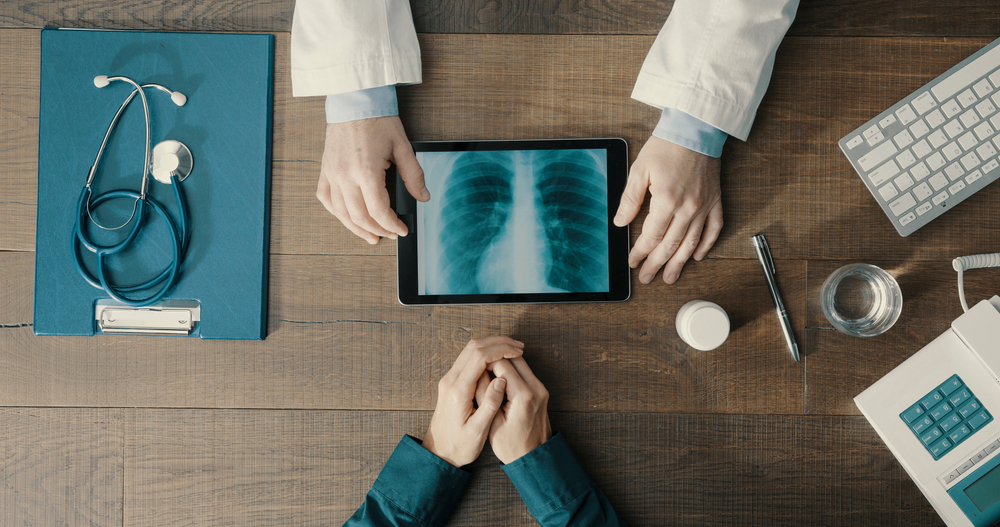

Cancer: Why screen, and what will it cost you?

26 March 2024 · Fiona Zerbst

Cancer screening can help save lives. We investigate why you should screen, which tests are recommended, and what they may cost you.

Who needs a power of attorney?

1 February 2024 · Fiona Zerbst

A power of attorney is a legal document granting someone the authority to act on your behalf. We explain why and when you may need it.

Special needs child? Choose your medical cover wisely

16 January 2024 · Fiona Zerbst

Children with special needs often require specialised medical care. We explore what medical schemes in South Africa can offer.

Should you downgrade your medical aid option?

19 December 2023 · Lauren Burley Copley

In response to rising medical inflation, many South Africans are downgrading their medical aid option. We outline the alternatives and risks.

Insurance for digital nomads: What’s needed?

21 September 2023 · Fiona Zerbst

Digital nomads are travellers who work remotely in various locations around the world. We examine what types of insurance they may need.

The difference between funeral cover and life insurance

15 August 2023 · Fiona Zerbst

Funeral cover and life insurance provide vital financial protection for you and your family. We explore key differences between them, and the benefits of each.

How is a car’s replacement value determined?

21 July 2023 · Fiona Zerbst

It’s common for vehicle owners whose car is written off or stolen to feel that the replacement value is inadequate. We consider how to avoid this situation.

How NHI will affect your medical aid membership

19 July 2023 · Fiona Zerbst

The National Health Insurance (NHI) Bill aims to introduce universal health insurance in South Africa. We examine how it may affect medical aid members.