Tony Barrett from FNB explains the implications of the proposed changes to capital gains tax.

8 March 2016 · Jessica Anne Wood

During his budget speck earlier this month, the Minister of Finance Pravin Gordhan announced changes to Capital Gains Tax (CGT). CGT has increased from 33.3% to 40% for individuals, and from 66.6% to 80% for trusts and companies.

According to Tony Barrett, a wealth manager at First National Bank (FNB) Financial Advisory, this will mainly affect high-net worth individuals. “CGT implications are of particular importance as they have been a feature of the South African financial environment since 1 October 2001. Although the initial impact was small, with asset price increases being rather substantial, it has truly become a stealth tax in recent time,” he said.

What do the changes mean?

Barrett noted that in simple terms, the increase in CGT, means that 40% of all capital gains are now added to an individual’s taxable income. This is also true for companies and trusts, where the amount is 80%. Furthermore, for individuals and trusts the maximum marginal income tax rate remains at 41%, while for companies the tax rate is 28%.

How it works in practice

Barrett provided the following example to illustrate the impact that CGT can have on a person’s investment returns.

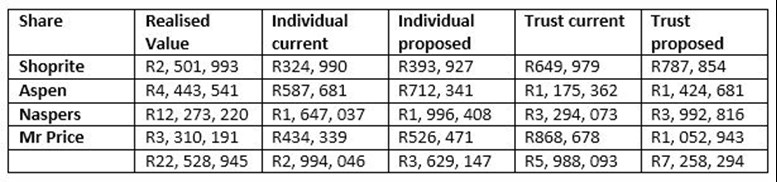

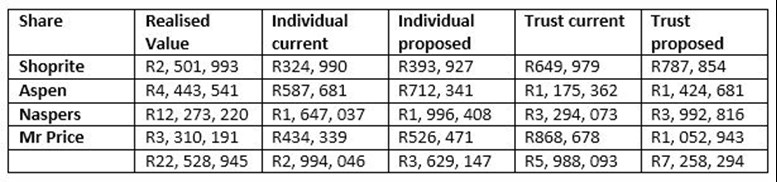

Assuming that on the 1 October 2001 an individual and a trust each invested R100 000 in each of the following JSE-listed shares: Shoprite, Aspen, Naspers and Mr Price. The below table illustrates the implications of CGT if the shares were sold prior to 29 February 2016 (before the changes came into effect) or after 1 March 2016 under the proposed new inclusion rate dispensation.

Both instances use the selling price on 24 February 2016 and the values reflected as follows:

Source: FNB

From the table above, it is evident that there is a jump between the current CGT that a person pays and the proposed rate as of the 2016 budget speech. In effect, the increase in CGT inclusion rate impacts the realised value of the portfolio, as the investor will come out with less.

“This jump puts many investors in a veritable ‘no mans’ land due to the debilitating effect of CGT on a portfolio’s realised value. It also constrains the flexibility and accessibility of funds. After all, as people’s circumstances and needs change at different stages of life, they will only naturally want to dispose of certain assets in order to purchase new ones that better suit their requirements. CGT never goes away, on death the deceased is presumed to have disposed of his assets the day before he passes away and his executor is required to compute the CGT owed during the winding up of the estate,” stated Barrett.

When asked if people should still invest in trusts, Barrett said the answer to this is yes and no. “You should not invest in a trust if tax is the main driving factor for you making that investment. You invest in trusts for other reasons, for instance if you have minor children. Often we find in divorces where there is his, hers and ours in terms of kids that a trust will be set up for the benefit of one grouping, or one member of the family grouping. It must be for the protection of assets from creditors. There should be other issues. Tax must never be the driving issue for forming a trust. So it still has its place as a vehicle and a structure.”

What is Capital Gains Tax?

CGT, as explained by the South African Revenue Service (SARS), is “not a separate tax but forms part of income tax. A capital gain arises when you dispose of an asset on or after 1 October 2001 for proceeds that exceed its base cost.”

Furthermore, SARS revealed: “All capital gains and capital losses made on the disposal of assets are subject to CGT unless excluded by specific provisions.”

Barrett elaborated: “CGT is not a new tax, it is just an amount of income that is added to your normal taxable income, i.e. your salary or your interest or whatever. But it is derived from the gains that you make on capital assets. For instance, if you buy a share for R100 and sell it five years later for R500, you’ve made R400 gain. A certain percentage of that gain will then be added to your taxable income.”

He added: “It is paid every year, but during the course of the tax year, 1 March to 28 February. Like your tax return for that tax year you have to put in all the income that you earn for that year, likewise you have to include all your capital gain that you earn for that year, and then behind the scenes, SARS do the number crunching and work out what the inclusion rate is and what the tax is.”

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.