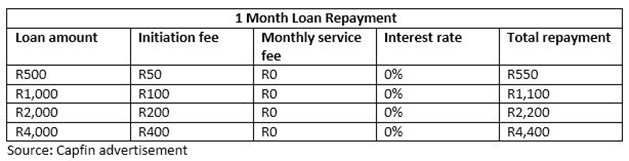

Capfin is offering customers a one month interest free loan with a 10% initiation charge.

9 March 2016 · Jessica Anne Wood

Capfin is offering interest free loans to a maximum amount of R4,000. This was brought to Justmoney’s attention through a point of sale material in PEP, one of Capfin’s partners

Danie Du Toit, group operations director at Capfin, explained to Justmoney: “The maximum possible amount is R4000, per the grid in the advertisement. Individual limits depend on affordability and Capfin’s credit criteria.”

The loan is repayable within one month. There is no interest charged on the loan, however, there is an initiation fee. (See the table below)

Du Toit elaborated: “Per the advertisement there is only a once off initiation fee equal to 10% of the loan amount. Capfin will not charge additional fees or interest if the instalment is not paid within one month.”

According to Du Toit, anyone that meets Capfin’s credit criteria and affordability assessment qualifies for the product. He added: “There is no alternative 1-month product in the market that offers the fee structure that we do.”

|

The loan

In order to apply for the loan, you are required to present your I.D. document, as well as three months’ worth of proof of income. According to the Capfin advertisement, they will get back to you in five minutes to inform you whether or not you have qualified for the loan.

You can apply in-store at Pep for this Capfin loan.

For more information on Capfin, click here.

|

|

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.