The FSB is investigating sic funeral policy providers for illegally selling the policies.

10 March 2016 · Jessica Anne Wood

The Financial Services Board (FSB) is warning people against purchasing funeral policies from six companies. These companies are currently being investigated by the FSB. (Scroll down for a list of the companies)

In a statement the FSB said: “These entities were requested by the FSB to provide proof that their funeral policies are underwritten by a registered long-term insurance company, as required by law, and were afforded 10 days to respond. The entities have either failed to respond to this request or have failed to confirm that their funeral policies are underwritten by a registered long-term insurance company.”

The FSB has highlighted that it takes action against any entities that sell funeral policies to the public which are not underwritten by a registered long-term insurance company. “This conduct amounts to running unregistered insurance business thus breaching the provisions of the Long-term Insurance Act 52 of 1998,” explained the FSB.

If any entity, such as the companies currently being investigated, are found to be in breach of the act, they may be subject to a fine or imprisonment upon conviction.

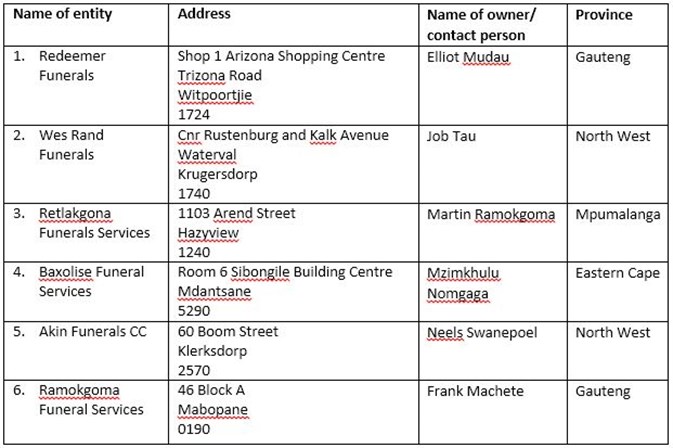

The companies

The below table was provided by the FSB detailing the name, location and contact person for the various companies being investigated.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.