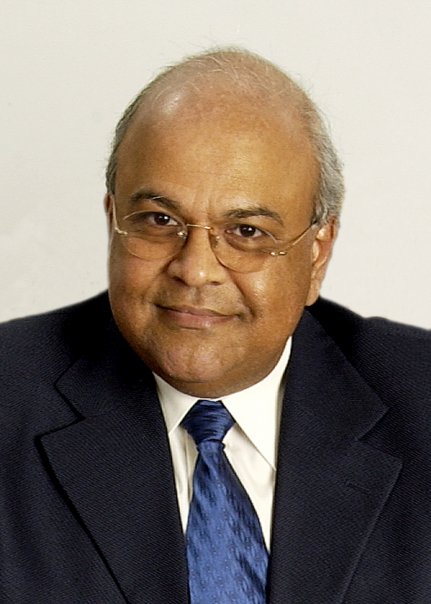

South Africa's Finance Minister, Pravin Gordhan, has reacted to the Brexit (British Exit) and has made reassurances to the South African public that the situation will be monitored closely by Treasury and government.

23 June 2016 · Angelique Ruzicka

Finance Minister, Pravin Gordhan, has just released a statement following the Brexit (British Exit) referendum. It follows after a majority of the British people (51.9%) that came to vote yesterday, voted in favour of leaving the European Union. It was a close call with 48.1% of the 72.2% of voters that turned out voting in favour of remaining. But this wasn't enough to secure Britain with the European Union.

“South Africa woke up to the news today that the British citizens had decided to exit the European Union. Clearly Given the size of the British and European economies and South Africa’s links to these economies this is a significant decision made by the British public which could have consequences both for that particular part of the world and ourselves as well,” said Gordhan.

He reminded South African’s that it will be some time before the agreements and negotiations following the referendum will apply. “It will be useful for us to remember that it takes two years of negotiations between Britain and the European Union for any break in the relationship to be concluded.

“We have been saying for some time now that the process would result in volatility in the financial market and in sentiment and confidence and this is clearly the case in the events that have unfolded today.”

At the time of writing by 8% today. Gordhan added: “Currencies have become volatile, the Rand has depreciated, the share market in the London Stock exchange has lost significant amounts of money and all of these are reactions to the decisions that have been made in the United Kingdom.

“However, the trade links between South Africa and the European Union and Britain are fairly strong and are based on solid agreements and we have a two year period during which whatever changes need to be made to agreements and treaties can in fact be met.

Gordhan made assurances that the government will watch closely as developments in the UK and EU unfold. “The National Treasury and the Reserve Bank have met this morning and are keenly monitoring developments that are taking place and the implications for South Africa and will continue to do so over the next few days and will keep the South African public informed about the developments and the implications for us and if there are any measures that need to be taken.

“The South African public can be reassured that our banking and financial institutions are well position to withstand financial shocks and this is what was demonstrated in the period leading up to the great recession in 2008 and 2009 where the system demonstrated its resilience. Equally, we are confident that our financial system including the banks and the regulatory framework that we operate under are resilient and reliable.

“The monitoring of these processes and events will continue into next week but this is the time where the efforts that government, business and labour that have put into avoiding a downgrade must now continue into ensuring that we collectively stabilise our economy, reassure the financial markets and inspire confidence both amongst South Africans, and those interested in investing in South Africa that we are indeed a country where there is a set of resilient intuitions on the one hand and that we as a country are open for business as we hold sail.

“So the kind of co-operation that we have seen between government, labour and business to re-ignite growth must continue with the greatest sense of urgency and is quite critical to stabilising the environment notwithstanding what might be happening within the European context.”

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.