If you need a pair of spectacles but don’t have medical aid or can’t afford to purchase them cash, Spec-Savers has a store account where you can pay on credit and get six months interest free.

3 July 2016 · Jessica Anne Wood

If you need a pair of spectacles but don’t have medical aid or can’t afford to purchase them cash, Spec-Savers has a store account where you can pay on credit. You can apply via SMS or by completing a form in store.

According to Spec-Savers, you get six months interest free, after which you pay interest of Prime + 11.5% (currently 21.25%). There is a once-off initiation fee of R49, as well as a monthly administration fee of R24. You have 18 months in which to pay-off your purchase. Spec-Savers emphasised that there are “no hidden fees for top-up payments.”

These are:

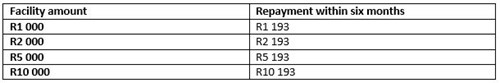

If you take full advantage of the six month interest free period, you will pay your monthly instalment for the frames and lenses you have purchased, the R49 initiation fee and R24 per month. This would total R193 + the value of your frames and lenses. If you were to use the maximum amount per facility amount and repay it in full within the six month interest free period, you would pay:

In the brochure, Specsavers explained: “Spec-Savers Credit is provided by FeverTree Finance (Pty) Ltd a registered credit provider. Each month FeverTree will automatically draw the agreed amount from your bank account via debit order.”

You can apply for a Spec-Savers account via SMS. You simply SMS your details to 45140. The details required are: Name*Surname*ID Number*Monthly Income. Details must be separated with an asterisk (*).

To apply for a Spec-Savers account, the below steps are followed:

*Spec-Savers reserves the right to do a background credit check which may take up to 24 hours.

Alternatively, you can apply online by following this link: http://www.specsavers.co.za/page/online-credit-application.

It is important to be careful when purchasing items on credit. Spec-Savers warned: “Please keep in mind to use your credit responsibly – budget carefully and do not spend more than you can afford to repay. Keep your credit up to date because it will affect your credit rating in the future.”

Spec-Savers has also partnered with MyOwn Loyalty to offer customers rewards when they spend in store.

The MyOwn Loyalty website explained: “MyOwn Loyalty membership is free and allows you to earn and spend MyOwn points at leading healthcare retailers, medical practitioners, better-for-you brands and retailers – giving you access to exclusive deals and offers.”

Partners include eyebar branded sunglasses, Spec-Savers and Execuspecs branded eyewear. You earn 2.5% of your invoice value back on your card, which can then be used at one of the partner retailers.

For more information on the Spec-Savers account, click here.

Handy tip: If you have too much credit and are struggling to repay your debt, debt counselling might be a solution. You can apply through Justmoney.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.