It’s no surprise that right from the start Finance Minister Pravin Gordhan would not be drawn in on any questions surrounding his long term battle with the Hawks on alleged fraud charges and setting up of a rogue unit at the South African...

25 October 2016 · Angelique Ruzicka

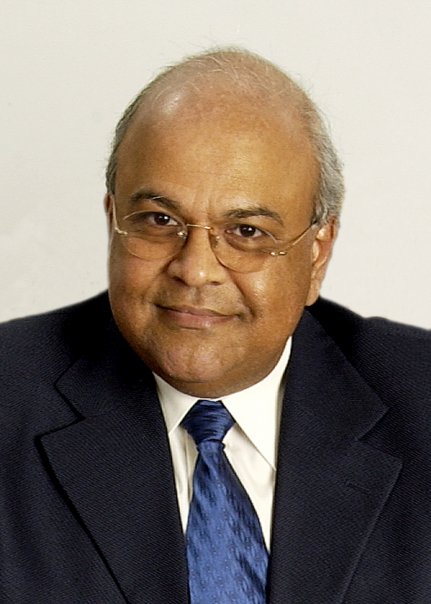

It’s no surprise that right from the start Finance Minister Pravin Gordhan would not be drawn in on any questions surrounding his long term battle with the Hawks on alleged fraud charges and setting up of a rogue unit at the South African Revenue Service (SARS). At the media conference earlier this morning some journalists tried to get him to comment, but he was having none of it. His focus, he says, is simply on the Medium Term Budget Policy Statement (MTBPS) and that we should direct our efforts and questions on that.

Another thing that he wouldn’t offer further comment on was the issue of taxes and whether any new taxes would be introduced or if any of the current ones we are subject to would be increased. He reminded us: “We don’t discuss tax choices in the MTBPS. The MTBPS is not a budget. We don’t deliver money here but this gives us the opportunities in the next month or so to introduce the highly technical proposals.”

But there were some things he was willing to expand on and we highlight these here:

After refusing to comment on the Hawks, State capture and any other cloudy issues that he currently faces, journalists jumped at the chance to grill the Minister on Eskom. He made assurances that government is closely monitoring SOEs, saying: “South African Airways (SAA), the South African Post Office (SAPO), SANRAL and Eskom, with the aim of stabilising these entities and mitigating any risks that materialise.”

But there were still questions around how Eskom would fund the nuclear deal. Earlier this month energy expert, Chris Yelland, told Justmoney that very few countries could foot the bill of nuclear projects on their own without some kind of appeal to the taxpayers to open their wallets. He reckoned South Africa would be no different.

On SAA, Gordhan announced that advisors will be appointed to provide technical assistance as government considers the possible realignment of its airline shareholdings.

Thanks to the #FeesMustFall movement Treasury and government have had to pay full attention to students and their concerns about financing their studies at university. While students are calling for free education there was no hint from government in providing this.

Gordhan admitted that universities may not have been awarded a fair cut, pointing out that while allocations have increased from 1% of GDP in 2008 to 1.5% today, most of the increased benefits have been awarded to vocational colleges, SETAs and the National Skills Fund, rather than universities.

However, Gordhan says that universities and students will receive an additional R17 billion over the medium term. With the amount of money that government dedicates to funding education in South Africa, it's hard to accuse it of not investing in the sector. Gordhan did point out that education is the second most expensive line item in the budget and that the bill for this increases substantially every year. Currently, university subsidies are increasing by 10.9% each year on average and NSFAS allocations are growing by 18.5%.

Confidence in the country has been crushed following lower than expected growth forecasts (growth is slower now at 0.5% than the predicted 0.9% back in February this year), threats of a downgrade of the country to junk status, the FeesMustFall movement, the state capture report and allegations of fraud and corruption by the Hawks on Pravin Gordhan. Government debt, which now exceeds R2 trillion, remains a concern too.

Gordhan, however, remains resolute in the face of these allegations and economic uncertainties and called for a package of actions to restore confidence, including:

- Finalising the regulatory framework for private-sector participation in infrastructure projects, including initiatives in partnership with state-owned companies.

- Addressing legislative and regulatory uncertainties that hold back investment in mining, agriculture and other key technology sectors.

- Rationalising, closing or selling off public assets that are no longer relevant to government’s development agenda, and strengthening those that are central to achieving the NDP objectives.

- Concluding labour market reforms.

Tax increases were hinted at with Gordhan saying that there will be tax measures introduced to raise an additional R13 billion in 2017/18. In addition to this, government will also propose measures to raise an additional revenue of R15 billion 2018/19. In his speech, Gordhan said: “In the current year, we now project R23 billion less revenue than the February estimate. Measures are likely to be needed in next year’s Budget to raise tax revenue by about R28 billion a year, while avoiding measures that would inhibit investment.”

Food prices have hiked up astronomically and Gordhan has made one mitigating move in his speech to help the poor stave off the struggle. “Taking into account the rise in food prices this year, I am pleased to confirm that an additional increase of R10 a month has been made to social grants with effect from October,” he says.

A difficult task in convincing the ratings agencies

Commentators are acknowledging that Gordhan has a difficult task ahead of him. Lew Geffen, chairman of Lew Geffen Sotheby’s International Realty, says Gordhan has been handed the proverbial sow’s ear by government and told to turn it into a publicly palatable silk purse.

“It’s unfortunate that the Finance Minister’s post doesn’t come with conjuring powers, because working as he is with one hand tied behind his back, it would have taken a magic wand for Gordhan to have been able to present anything other than a dismal economic outlook in his mini budget speech.”

He adds: “South Africa needs to see a drastic streamlining of the very bloated public sector and sharp cuts in superfluous government spending before a greater burden is passed onto what is actually a very small tax-paying base compared to the overall population of the country. A medium-term economic turnaround isn’t possible until that happens.”

The question remains whether Gordhan's measures will be enough to appease the ratings agencies and prevent them from downgrading South Africa to junk status: “Is it enough to keep S&P on hold in December 2016? It may just be. Rating agencies care about growth. The measured consolidation that Treasury has outlined shows a firm commitment to meeting the fiscal objectives they committed to in February 2016 without killing growth. A good portion of the Budget Review focuses on the structural and regulatory measures that are required to raise South Africa’s growth rate. Unless those are implemented, growth and revenues will continue to disappoint,” warns Nazmeera Moola, co-head of fixed income at Investec Asset Management.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.