Minister of Finance Pravin Gordhan announced a number of changes to tax for the 2017/2018 tax year. These proposals aim to raise an additional R28 billion in revenue.

21 February 2017 · Jessica Anne Wood

Minister of Finance Pravin Gordhan announced a number of changes to tax for the 2017/2018 tax year. These proposals aim to raise an additional R28 billion in revenue. According to the National Treasury, the sources of tax revenue for 2017/2018 will be:

Personal income tax

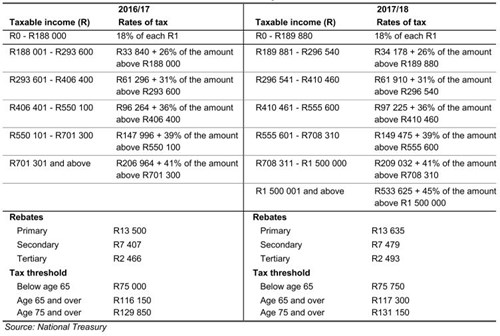

A new personal income tax bracket of 45% has been announced and will take effect from 1 March 2017. This tax bracket is proposed for taxable incomes above R1.5 million per year. This new top marginal income tax bracket, together with partial relief for bracket creep is expected to contribute R16.5 billion to tax revenue.

The Budget Review explains that bracket creep occurs when personal income tax tables are not fully adjusted for inflation.

In addition, the minister notes that the primary, secondary and tertiary rebates, and the levels of all the taxable income brackets, will increase by 1% from 1 March 2017.

Personal income tax makes up the largest portion of revenue collection for Treasury. When asked the minister stated that he is concerned about the shape of revenue collection within the country.

VAT

No changes to VAT have been announced for 2017/2018. However, the Minister announced the intention to expand the VAT base in 2018/2019. This includes the proposal to remove the zero-rating on fuel.

“To mitigate the effect on transport costs government will consider combining this with either a freeze or decrease in the fuel levy,” says Gordhan.

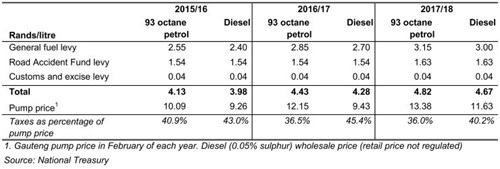

Fuel levy

As of April 2017, the fuel levy and Road Accident Fund (RAF) levy are set to increase. The minister announced a 30 cents per litre increase in the general fuel levy, and a 9 cents per litre increase in the RAF levy.

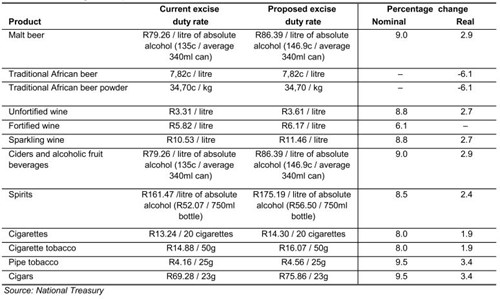

Excise duties: Alcoholic beverages and tobacco products

Each year sees an increase in the so-called ‘sin’ taxes, and 2017 is no different. Alcohol and tobacco products will see an increase of between 6.1% and 9.5% on affected products. Traditional African beer and Traditional African beer powder are excluded from this year’s excise duty increases.

Other tax changes

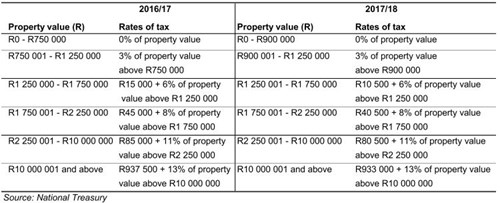

In addition to the above, there is a range of other taxes that will also see changes in 2017. From 1 March 2017 transfer duties will see a minimal change. The duty-free threshold on purchases of residential property will be raised from R750 000 to R900 000 to provide relief for lower and middle income households.

While still under discussion, the Minister noted that the sugar tax will be implemented “as soon as the necessary legislation is approved by Parliament ad signed by the President.” The proposed sugar tax rate will be 2.1 cents per gram for sugar content of 4 grams per 100 millilitres.

Lastly, a revised Carbon Tax Bill will be published for public comment and tabled in Parliament by mid-2017. The minister stressed that “during the first phase of the tax (until 2020), there will be no impact on the price of electricity.”

These are just a few of the tax changes that South Africans can expect to see this year. For further reading on other tax changes to come, click here.

|

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.