A new top personal income tax rate of 45% for those with personal incomes above R1.5billion has been announced by Finance Minister Pravin Gordhan in his Budget Speech today. But this may be a good thing as it could encourage people to invest mor...

21 February 2017 · Angelique Ruzicka

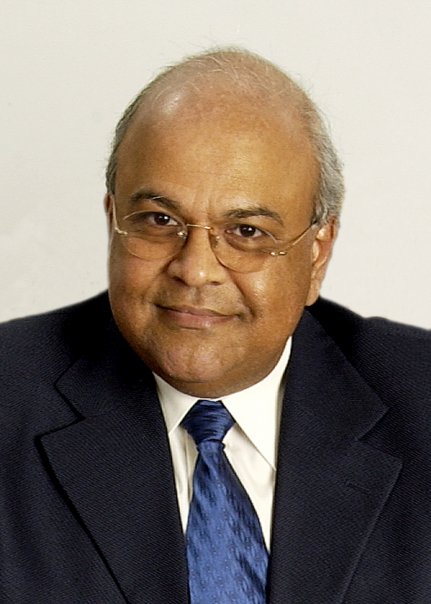

A new top personal income tax rate of 45% for those with personal incomes above R1.5 billion has been announced by Finance Minister Pravin Gordhan in his Budget Speech today. The last time personal income tax was hiked was in 2015, when an increase of 1% was implemented across all income brackets.

When Justmoney asked why government had chosen this this way of addressing the deficit, Gordhan referenced leading economist Tony Atkinson who passed away last year who argued that in developed and underdeveloped countries inequality should be the at the heart of what government addresses. “He even said 65% should be considered,” said Gordhan, adding, “We believe in a progressive tax system and the important role it plays on redistribution. We need to transfer from the well off to the rest of society, otherwise we wouldn’t have stability.”

Gordhan conceded that there could be risks to taxing high income earners. “There are always risks higher income earners making use of tax planning tools and tax evasion and it’s up to the South African Revenue Service to identify the risk of those schemes,” he added.

Meanwhile primary, secondary and tertiary rebates and the levels of all the taxable income brackets will be increased by 1% from 1 March 2017. The tax free threshold will increase from R75 000 to R75 750.

Why it’s a good thing…

While it will be a bitter pill to swallow for those affected in the short term it will provide a good opportunity to boost long-term retirement savings according to Jill Larkan, corporate liaison executive at leading financial advisory and wealth management business GTC.

“An increase in tax rates can be an excellent opportunity for boosting retirement savings – be it pension funds, provident funds or retirement annuities – because these long-term savings are tax-deductible,” she explained.

Contributions to a retirement fund can be deducted from individuals’ total tax liability, up to a rate of 27.5% of either their remuneration or taxable income (whichever is the greatest). So instead of wallowing in self-pity about having less to spend during income producing years Larkin believes this is the opportune time to cushion retirement vehicles and ensure that the golden years can be enjoyed instead.

“This is a very attractive incentive from the government for individuals to increase their retirement contributions, so that more people can retire comfortably,” added Larkan. “Even though this deduction is capped at a maximum annual amount of R350 000 we believe it is one of the best ways to maximise the long-term benefits from current retirement contributions.”

She adds: “Most of the retirement funds in South Africa – including GTC’s umbrella fund range – allow for individuals to make additional voluntary contributions to retirement savings, in order for them to get the biggest advantage from increasing their contributions.”

Pension fund options are also well-structured for investment growth. “An additional advantage of retirement savings is that the fund’s investment growth does not attract income tax or capital gains tax, which means individuals get the maximum benefit from appreciation in the fund’s value.”

She adds: “Looking further down the line, individuals currently receive an amount of up to R500 000 tax-free from their total lump sum upon retirement, with the balance taxed at favourable rates, which is much lower than marginal rates.”

Other non-taxable savings options

Investors will also cheer at the announcement that the annual allowance for TFSAs will be increased from R30, 000 to R33, 000. Unfortunately, the lifetime limit of R500, 000 has not been changed.

And while the medical tax credit will be increased in line with inflation this year, this may not be enjoyed for too much longer. “It should be noted though that consideration is being given to possible reductions in this subsidy in the future, as part of the financing framework for National Health Insurance,” said Gordhan in his speech.

Further reading

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.