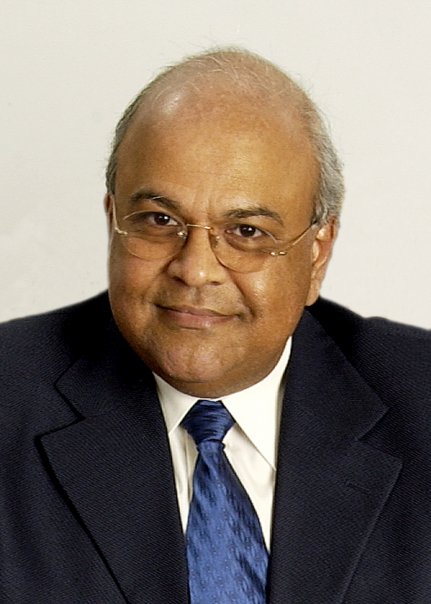

What was meant to be a week of Finance Minister Pravin Gordhan and his colleagues conducting the annual international investor roadshow, has turned into a week of economic and political uncertainty as Gordhan was recalled by President Jacob Zuma...

27 March 2017 · Danielle van Wyk

What was meant to be a week of Finance Minister Pravin Gordhan and his colleagues conducting the annual international investor roadshow, has turned into a week of economic and political uncertainty as Gordhan was recalled by President Jacob Zuma, yesterday. This has sparked talk of a cabinet reshuffle, a move which many think could not have come at a worst time.

At around mid-day yesterday Zuma ordered Minister Gordhan to return from the UK and announced that Jonas would no longer be travelling to the US as part of an international investor roadshow. “This sent the ZAR running for cover against the majors, as the USD/ZAR weakened 20c in matters of minutes to end the day 33c down at 12.7325,” reported John Moni, dealer at TreasuryOne.

The roadshow which is planned in advance is a critical part of investment development, especially after recent rocky economic conditions.

“These roadshows are meticulously planned and form an integral part of the post-Budget calendar. Roadshows such as this one provide an important opportunity for South Africa to update investors about recent policy developments and reassure them that our economy remains a good investment destination. Business, government and labour has made significant progress in the last 18 months in building confidence in our country among investors and rating agencies. These roadshows are an essential element of building confidence. This action by the Presidency rolls back the progress we have made as a country. It also militates against the imperative of ensuring political and policy certainty,” stated Cas Coovadia managing director of the Banking Association of South Africa (BASA).

Further concern stems from the fact that ratings agencies are due to visit South Africa soon as part of their mid-year ratings reviews.

“Another potential outcome of this action could be a consideration by rating agencies to downgrade SA to sub-investment grade status. This would be very negative for banks and other corporates, whose ratings would follow the sovereign,” added Coovadia.

The rumours and headliners doing the rounds echo the familiar tone of indirect intervention from the Gupta family, said Moni, adding: “According to a few articles, they are badly cash-strapped and are in desperate need of funds heading into what is going to be interesting court battle between Gordhan (and all us honest tax paying citizens) vs. the Guptas (and those on their pay roll).”

To make matters worse the Guptas might be a step ahead of the game. By having Brian Molefe enrolled into parliament this could align him up perfectly as a candidate for the role of Finance Minister should Gordhan be removed from the cabinet, continued Moni.

The local currency, in addition, lost around 3% on Monday post the statement from the Presidency, a familiar narrative to when ex-Finance Minister Nhlanhla Nene was axed in December 2015, reported EWN.

Nomura economists agree that this decision seems to be a power play on Zuma’s part and with not much information being given as to the recall, the nation can only but speculate and wait with baited breath.

This is a dramatic shift given that after the last reshuffle there was an understanding that Gordhan was safe in his role as Finance Minister. But this has changed. “The chances of his exit are now clearly higher. However Gordhan is used to playing such high stake political poker games. It seems this week is going to be really decisive either way. It is also possibly that Zuma wants Gordhan there if he only reshuffles the deputy. I have heard no other convincing argument but that this is a test of the split we've had with market opinion and is impossible to call given it ultimately comes down to Zuma's risk aversion or not on the issue,” explained Nomura analyst, Peter Montalto.

Despite the outcome, the Rand as well as investor confidence has already taken a knock, and it’s one that South Africa can ill afford.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.