Following on last week’s cabinet reshuffle and the protest that launched against Zuma, communication has been doing the rounds on a rumoured South African #NationalShutDown on Friday 7 April.

2 April 2017 · Danielle van Wyk

While investigation into the validity of the campaign is still being done, the Justmoney team took to the streets in asking ordinary citizens about whether or not they would support such a protest.

Following on last week’s cabinet reshuffle and the protest that launched against Zuma, communication has been doing the rounds on a rumoured South African #NationalShutDown on Friday 7 April.

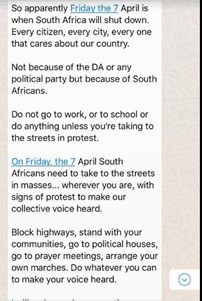

From whatsapp broadcast messages to tweets, irate South African citizens have been rallying around the idea of a complete workforce shutdown. This requiring the country to come to a complete standstill in mobilising in protest against Zuma and his leadership.

While a worthy cause to some, this scale of shut down and talk of skipping work could cost the country millions. As businesses lose out on an entire day of work, workers too would bear the brunt as they stand the chance of not being paid, a luxury which many cannot afford.

Further call for blocking highways, and arranging mass marches through central city areas are also on the cards. Although no specifics have yet been given, with the notorious violent local protest culture the City have responded by saying: “Any planned gathering needs to be done in terms of the Regulation of Gatherings Act. The South African Police Service (SAPS) is the lead agent with regard to the enforcement of this Act, with City enforcement agencies playing a supporting role if required,” added mayoral committee member for Safety and Security and Social Services, alderman JP Smith.

An example of a whatsapp text doing the rounds:

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.