Liberty has launched an app to make investing simpler. Currently only available on Android devices, Stash allows you to invest each time you swipe your card, with no service fees attached to using the app.

8 May 2017 · Jessica Anne Wood

Liberty has launched an app to make investing simpler. Currently only available on Android devices, Stash allows you to invest each time you swipe your card, with no service fees attached to using the app.

The app was developed to address the poor savings culture in South Africa. “Stash is an investment app designed to break through all the complicated investment jargon, processes, tedious forms, cashing out difficulties and reduces the amount of time it takes to meet with a financial adviser,” explained Liberty.

At a media event in Cape Town Juan Labuschagne, head of development at Stash, explained that Stash links to your bank account and withdraws the amount you set on the app each time you make a purchase using your card.

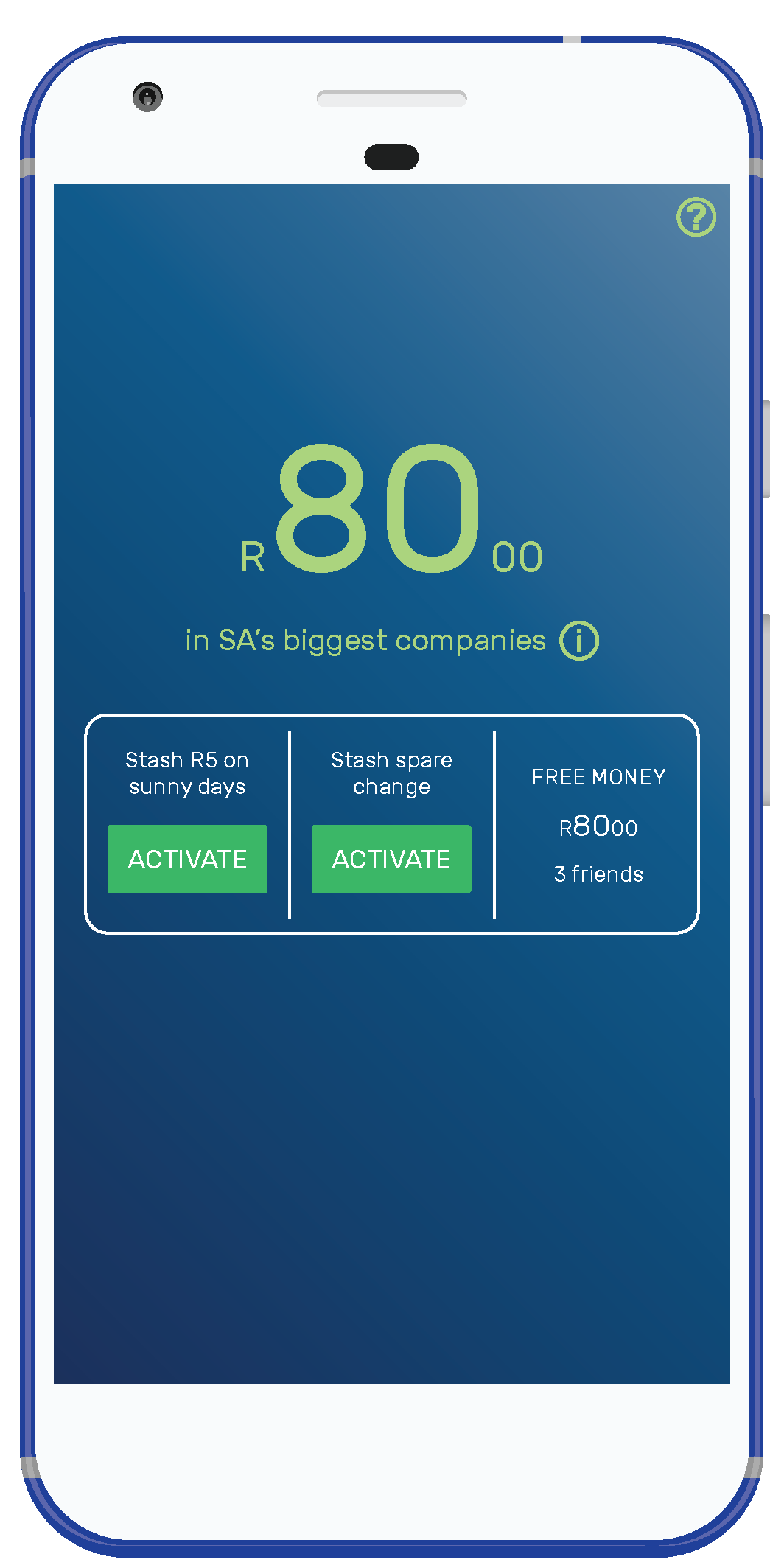

“Users decide how much they want to stash. The app rounds up the amount of every transaction (either to the nearest R10, R20 or R50). If a user decides that their Stash limit per transaction is R10 and they make a transaction for R45, this would be rounded up to R50. The R5 in change is stashed,” he clarified.

Using Stash

Stash is looking to launch the app for iOS users later this year. However, for those with Android devices, Labuschagne claimed that it takes only 49 seconds to get Stash and set it up. You can stop a transaction being Stash before 13:00 each day via the app.

The app is available on the Google Play store. Once you’ve downloaded it, the app only requires your name and cell phone number. It will ask permission to access your SMS services, this is to access your spending information through your bank SMS notifications, which will inform the app how much to deduct from your account and invest in your Stash.

Labuschagne clarified: “All this spare change accumulates without interfering with your day-to-day life. Stash checks your daily bank balance and never transfers more than you can afford, so you don’t have to worry about going into overdraft. Before you know it you’ll have a significant Stash balance. Your Stash grows as fast as South Africa’s biggest companies do because your spare change is invested in South Africa’s top 40 listed companies.”

Your investment

Stash is wrapped in a tax free savings product, which means you have an annual limit of R33 000 you can invest, with a lifetime limit of R500 000 (as a total of all your tax free investments). As it is a financial product, you will be required to FICA, however, this is not necessary at sign up stage. FICA is only required here when you invest more than R2000 per month.

When it comes time to withdraw your Stash, the money will be deposited into the bank account linked to the app. You will have to FICA here, however, Stash have aimed to make this a simple process. The app allows you to take a photo of your ID and proof of residence, and uses technology to detect fraud.

You can withdraw your funds at any time, without paying a penalty fee.

Increasing your Stash

You can invite friends to sign up to Stash, and for each friend that signs on, you get an additional R10 in your Stash. There is also a promotion currently running where you automatically get R50 when you sign up.

There are other features on Stash that allow you to increase your daily Stash. For example, you can Stash on sunny days. This requires the app to know your location and based on the weather where you are, you can either Stash a specific amount when it is sunny, or Stash the actual temperature.

Each day, you are also given the option to Stash an extra R10.

Another feature is the ‘Safe to Save’ functionality. “Stash checks your daily bank balance and tries to move money from your bank account to your Stash. Stash never transfers more than you can afford, so you don’t have to worry about going into overdraft,” explains the Stash website.

The cost of the app

As already stated, there are no fees attached to the app. However, nothing is free. Labuschagne revealed that the ‘payment’ Liberty receives from offering the app is information. Each time you make a payment using the card/s linked to Stash, Liberty gathers data on your spending habits. This is accumulated and can be analysed (your personal information remains anonymous).

However, Labuschagne highlighted that while this is a possibility, at this stage the information gathered has not been analysed. He emphasised that your personal information will not be sold.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.