Even though cheque books have become outdated, cheque accounts remain popular among South African adults. Justmoney has a look at the most affordable cheque accounts that each of the ‘big five’ South African banks have to offer.

13 August 2017 · Isabelle Coetzee

Even though cheque books have become outdated, cheque accounts remain popular among South African adults.

Both cheque and savings accounts are considered transactional accounts and they have similar features, including being used to draw money, make purchases, and to do internet banking.

However, as opposed to a savings account, a cheque account does not offer interest on positive balances and account holders can purchase goods and services on negative balances (overdraft).

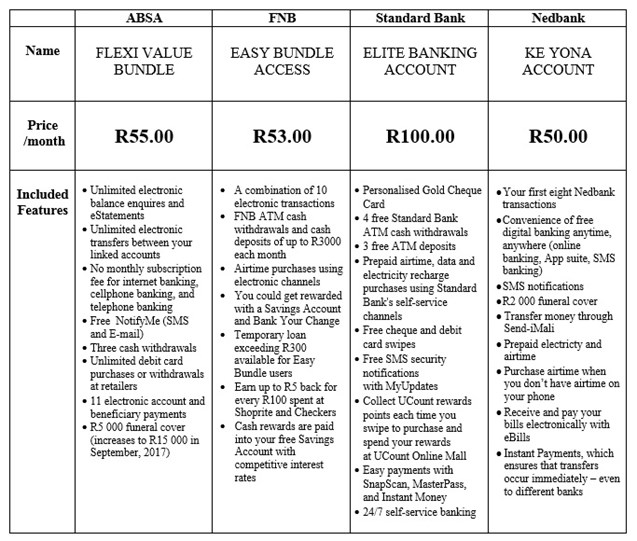

Justmoney has a look at the most affordable cheque accounts that each of the ‘big five’ South African banks have to offer, and here’s what we found:

1. ABSA

Their Flexi Value Bundle costs only R55.00 per month and is aimed at adults earning between R3 000 and R10 000. They wanted to optimise functionality, pricing, and value add-ons with the Flexi Value Bundle.

“The Flexi Value Bundle is a complete solution in terms of what it can do. We took into account the most preferred transaction types and included them as a bundle of discounted transactions which we offered within the bundle at a discount,” an ABSA spokesperson says.

ABSA found that customers struggled to keep track of different banking costs, so they merged these costs into a single bundle price.

“With a bundle price, if a customer uses the types of transactions included in the bundle, he or she will pay the bundle price, and no more,” the spokesperson adds.

The Flexi value bundle also offers R5 000 funeral cover at no extra cost.

“As we continuously review how best to make a difference to our customers, we established that R5 000 was not enough. From 1 September 2017, the funeral cover will now be R15 000 at no additional costs,” says the spokesperson.

2. FNB

The Easy Bundle Account, offered by FNB, costs R53.00 per month and this fee has only increased by 8% since its inception in 2012.

“Retail banking has become increasingly competitive and when reviewing our competitors in detail, we see that a race to the lowest price-point ends up costing the consumer more as many additional services are required,” says Ryan Prozesky. CEO of FNB Value Banking Solutions.

The Easy Bundle Account offers free FNB ATM/Slimline, Cash@Till, and cardless cash withdrawals of up to a value of R3 000 each month. The same services would have cost over R55 on FNB’s Easy PAYU account per month.

In addition, customers also receive free cash deposits for a value of up to R3 000 per month from any FNB ATM - the same would have cost R27 using the Easy PAYU account. And on the Easy Bundle Account 10 transactions are included in the monthly fee, and inContact notifications are also available.

3. Capitec Bank

Among the big five banks, Capitec Bank is the only one that does not offer a traditional cheque account. Instead, they offer a Savings Account that can perform the most pertinent functions of a cheque account.

“The major benefit of running it on a savings platform is that consumers earn interest from the first Rand in their account. The interest earned can be offset against their transactional account fees and could even help them to bank for free,” says Charl Nel, spokesperson for Capitec Bank.

“Cheque accounts on the other hand offer very little interest. Capitec runs its transactional account on a Savings Account platform to the benefit of the consumer,” Nel adds.

4. Standard Bank

According to Kuben Chetty, head of transactional, savings and investments at Standard Bank, the Elite Banking Cheque Account, is their most affordable cheque account, costing only R100.00 per month

"It offers a range of features and benefits that enables efficient everyday banking for the modern user, such as safe, easy payments with SnapScan, MasterPass, and Instant Money.

Elite Banking also offers 24/7 self-service banking through their app, as well as cellphone and online banking, and free monthly e-statements.

5. Nedbank

The Ke Yona Account, offered by Nedbank, has a monthly fee of only R50 and it includes eight Nedbank transactions for that period.

“Nedbank has a number of affordable options to suit all consumer segments’ banking needs,” says Phillipa Weimer, head transactional product at Nedbank Retail.

“The R50 monthly fee includes full access to all digital channels, unlimited card swipes and SMS notifications,” she adds.

Nedbank also offers a basic pay-as-you-use account for only R5.00 a month, but depending on the amount of transactions you make, this may be less affordable than the Ke Yona Account.

Additionally, the Ke Yona Account also includes R2 000 funeral cover, as well as SMS notifications.

Cheque accounts at a glance:

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.