The South African Revenue Service (SARS) has only received 606 applications from taxpayers declaring their offshore assets and incomes for their Special Voluntary Disclosure Programme (SVDP).

23 August 2017 · Isabelle Coetzee

The South African Revenue Service (SARS) only received 606 applications from taxpayers declaring their offshore assets and incomes for their Special Voluntary Disclosure Programme (SVDP) by Thursday, 21 August.

This is low compared to 2003 when over 40 000 applications were made for the Exchange Control and Tax Amnesty.

SARS, however, cautions against comparing the two programmes.

“During 2003, there was only one option for disclosure, not two as we have now,” said Sandile Memela, spokesperson for SARS.

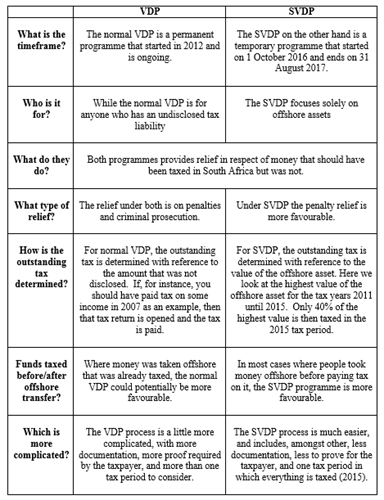

“Taxpayers now have the option to choose between the normal Voluntary Disclosure Programme (VDP) and the SVDP, depending on which of the two programmes best fits their circumstances,” he added.

According to SARS, these are the key differences between the two programmes:

Some people just aren’t “tax smart”

Darren Britz, admitted attorney of the High Court who specialises in SARS’s permanent VDP, agrees that the amount of applications are not truly comparable.

“Many taxpayers – perhaps even the majority – have opted to make an application in terms of SARS’ permanent VDP,” said Britz.

He explained that there is a perception that the SVDP and VDP applications are only for “tax dodgers” while very often the opposite is true.

“Certain taxpayers are just not tax smart and unintentionally omit certain items from their income tax returns. For these taxpayers, the VDP process will assist to remedy their prior non-disclosures,” he said.

“Any taxpayer who has previously failed to disclose their offshore assets or income should seek legal advice regarding their tax obligations and remedy any historical non-disclosures through a VDP where possible,” he advised.

International banking information made available to SARS

Those who do not make use of this opportunity may face huge financial losses after August this year.

Ruaan van Eeden, head of tax at the Geneva Management Group, said that what makes the SVDP different from previous programmes is that it is being done in anticipation of the implementation of the Common Reporting Standards (CRS) on 1 September, 2017.

“This is a new initiative internationally to ensure that third party information, such as the information held by banks and investment managers, is made available to authorities in other countries,” Van Eeden explained.

“This means that there is now an onus on financial and other institutions across the globe to share information about ownership of assets,” he added.

In other words, SARS will be able to trace South Africans’ offshore assets, and if they have not been declared they could face large financial penalties.

Natalie Napier, partner at Hogan Lovells specialising in tax law, explains that, “The CRS essentially ‘follows the money’, in that unless an individual keeps their money under their mattress, it must be held in a bank account at a financial institution.”

“Any information collected in respect of an account identified as reportable will be relayed to the off-shore tax authority who will then have an obligation to report that information to the South African Revenue Service,” said Napier.

Consequences of not declaring offshore assets

According to Van Eeden, perpetrators face an Understatement Penalty of up to 200% of the owed taxes, plus interest, and the potential for criminal prosecution.

He believes that, “Since the period available for participating in the VDP has been quite long and well publicised, SARS is likely to apply a heavy hand with offenders.”

Additionally, if a perpetrator is successfully prosecuted their name will be publicised and they could face up to 5 years imprisonment for each instance of tax evasion.

Taxpayers have until 31 August, 2017 to declare their offshore assets and incomes through the SVDP,

After this the CRS will kick in and those who have not declared their offshore assets and incomes will have to bear the consequences.

Click here for step-by-step instructions on how to apply for the SVDP and the ongoing VDP.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.