Insurer Dialdirect has launched an app which it claims will help drivers earn more money and improve driver safety.

28 August 2017 · Angelique Ruzicka

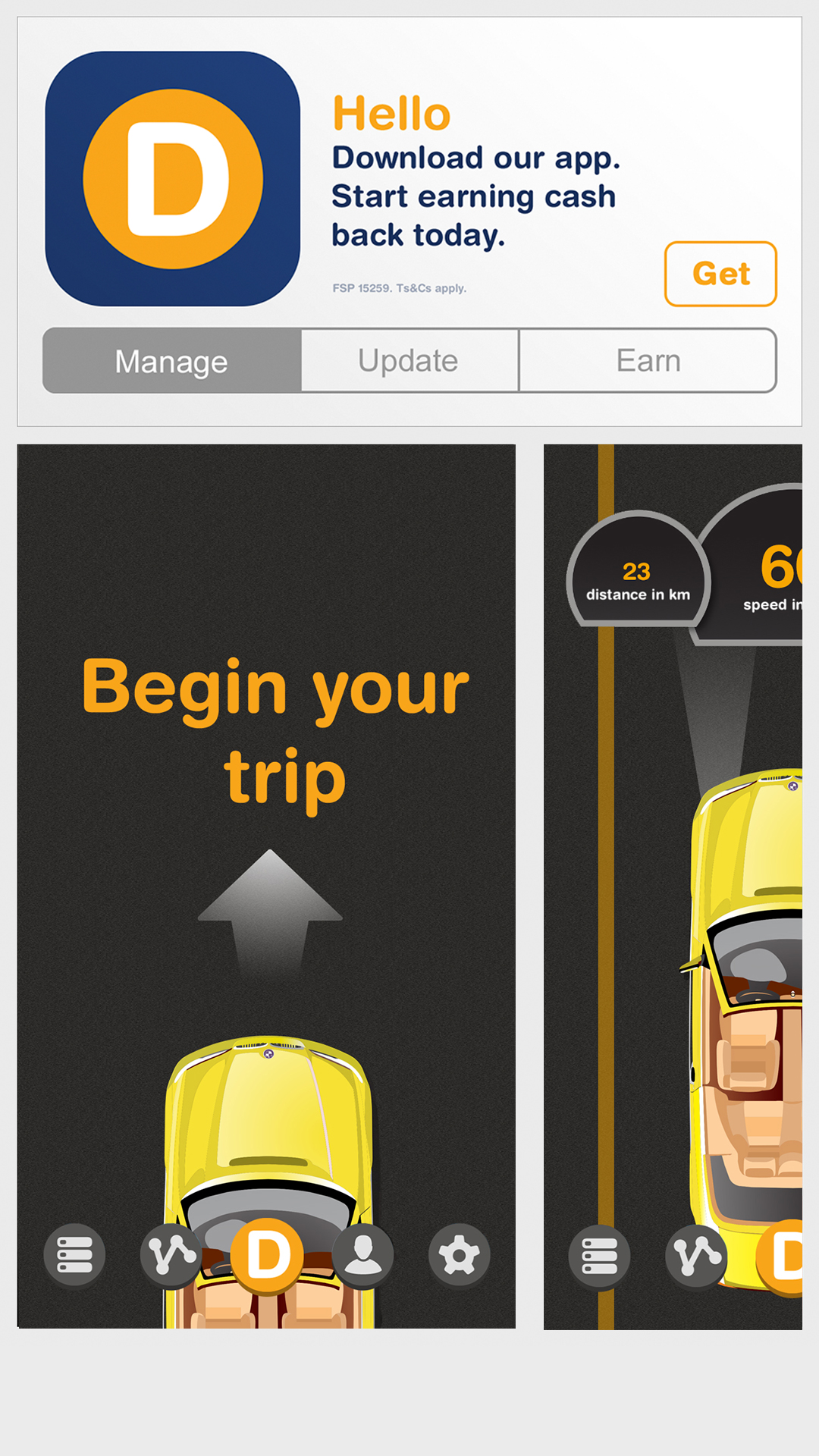

Insurer Dialdirect has launched an app which it claims will help drivers earn more money and improve driver safety. The app, which can be downloaded via Playstore or iTunes, uses the latest in international telematics technology to monitor driving behaviour. “If you drive and insure right, you can get up to 75% cash back, every single month. This is significantly higher than the rewards programmes offered by any competing insurance brands and is the first offering of its kind in the market,” said the insurer in a statement.

To get cash back, customers drive safely and be insured with the provider. According to Warwick Scott-Rodger, executive head of Dialdirect: this partnership between insurers and drivers is not only limited to the cash-back transaction, but will extend to making a positive difference on South Africa’s roads. “Providing a financial incentive to drive right will make our roads safer – which is obviously in all of our best interests.”

The App’s payback functionality is available to Dialdirect customers, but anyone can benefit from a number of features on the app, including monitoring their driving, participating in driver challenges and winning vouchers.

How Dialdirect hopes to ensure better driving

One of the seven drive score factors that this new app measures is cellphone use – which is the cause of around 25% of accidents on South African roads. The other six factors are braking, acceleration, night-time driving, speeding, route risk index and distance.

“Improving on these seven drive scores will help in reducing the devastation we currently experience on our roads every day,” says Scott-Rodger.

How to earn cash through the app

Customers can boost their monthly earnings by adding other products such as home contents and buildings cover to their policies, and by completing additional activities like a vehicle safety check, an eye test and confirming their policy details. After four years of claims-free, uninterrupted cover, customers can get a further 25% of all their premiums back.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.