Most retirement products cost around 3% in fees. “Meh,” you say, “3% doesn’t sound so bad.” But paying it can mean you’ll retire with 40% less money.

11 December 2017 · 10x

Most retirement products cost around 3% in fees. “Meh,” you say, “3% doesn’t sound so bad.” But paying it can mean you’ll retire with 40% less money.

We know it sounds impossible. Presumably, if you’d told people 100 years ago that a car could go from 0 – 100kph in 10 seconds, they wouldn’t have believed it either. They’d have needed to see the car at a standing start and then accelerating. Of course, in the 21st century, 10 seconds is hardly remarkable because we’re accustomed to cars doing that. And perhaps one day we’ll be as familiar with the real cost of fees. But until then, it’s worth illustrating how investing costs accelerate over time.

The standing start

Let’s use a nice, simple, round number and assume that you invest R10,000. You don’t add or withdraw any money for 30 years.

Let’s also assume that your money grows at 6% above inflation every year for the 30 years. So after a year, your R10 000 is worth R10 600.

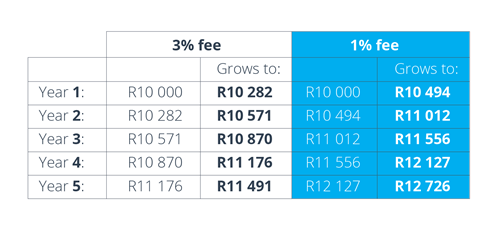

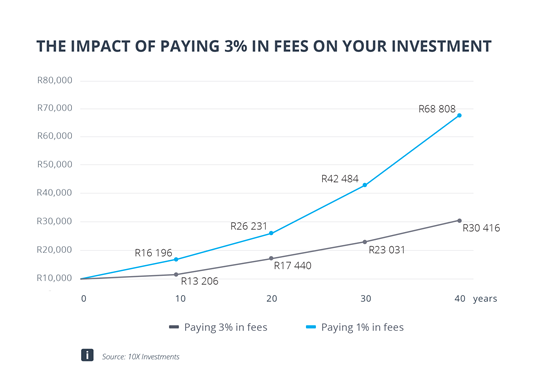

Now let’s see what starts happening to your money when you pay 3% in fees, compared with 1%.

R10 600 – 3% fees (R318) = R10 282

R10 600 – 1% fees (R106) = R10 494.

Sounds okay, right? At 3%, you’re only about R200 worse off. Even the next four years don’t look so different:

After five years, the more expensive investment is still only around R1 200 worse off. But it’s taken five years to get where the lower cost one got in three.

The acceleration

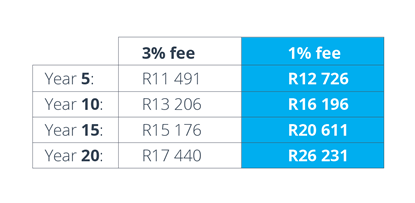

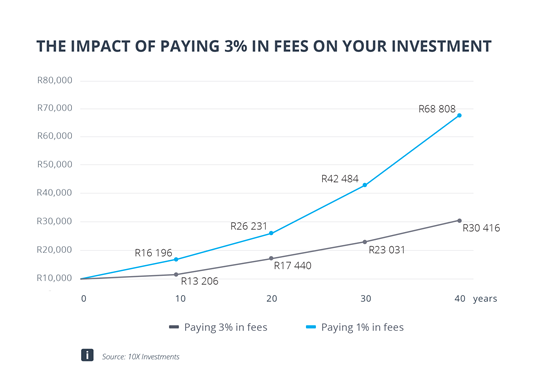

Now look what happens if we check in every five years rather than every year.

After year 20, the more expensive investment is worth R9,000 less than the low cost one. It’s also eight years behind – the low-cost fee got to R17,000 in year 12.

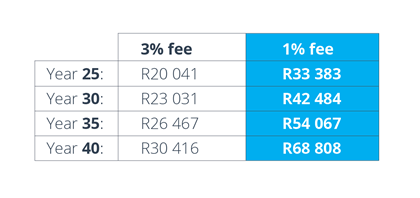

Over time, the gap keeps accelerating. And that’s when things start to get really fast. Try not to blink.

After 30 years of paying 3%, your R10 000 investment has grown to R23 000. At the lower cost of 1%, it’s worth R42 000. Paying 2% more has cost you more than 40%.

Don’t stop now.

What happens if you’re one of those diligent rarities who stays invested for an entire 40 year working life? You’ll end up with less than half. At 3%, your investment grows to R30 000. At 1%, it grows to R68 000.

Even if you paid 2% in fees for those 40 years, which is much better than paying 3%, you still only end up with R45 000. That’s only about two thirds of the R68 000 you get paying 1%.

Feeling queasy?

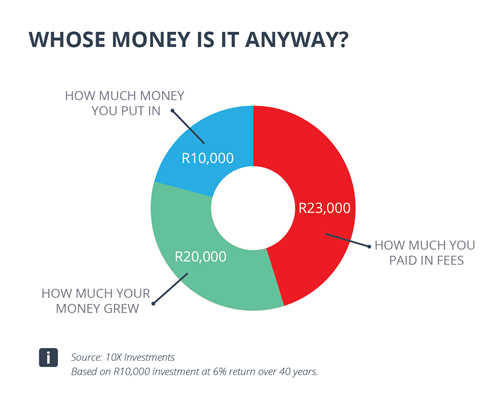

If high fees aren’t making you sick yet, consider this: although you get R30 000 out at the end, you started off with R10 000. So your money only grew by R20 000. What you don't see is that, over those 40 years, you’ll have paid a total of R23 000 in fees. In other words, you paid more money than you made.

Yes: you actually lost money.

Alas, fast cars and high investing costs don’t come with barf bags. And once that money’s gone, there’s no remedy. But there is a simple way to avoid feeling queasy.

Pay lower fees.

Ask for a free comparison and see how your current investment measures up.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.