“It must be my fault,” you think while hopelessly staring at the remnants of your financial security. But you might be wrong. Your financial instability may be derived from childhood trauma, rather than an innate character flaw.

18 April 2018 · Isabelle Coetzee

“It must be my fault,” you think while hopelessly staring at the remnants of your financial security. A pile of closed envelopes containing rent notices are scattered in front of you.

You’ve defaulted on budgets and hoarded letters of demand; the only logical explanation is that you’re terrible with money.

But you might be wrong. Your financial instability may be derived from childhood trauma, rather than an innate character flaw.

What is considered childhood trauma?

Morgan Mitchell, who works as a trauma counsellor, highlights the following experiences that can have long-lasting effects:

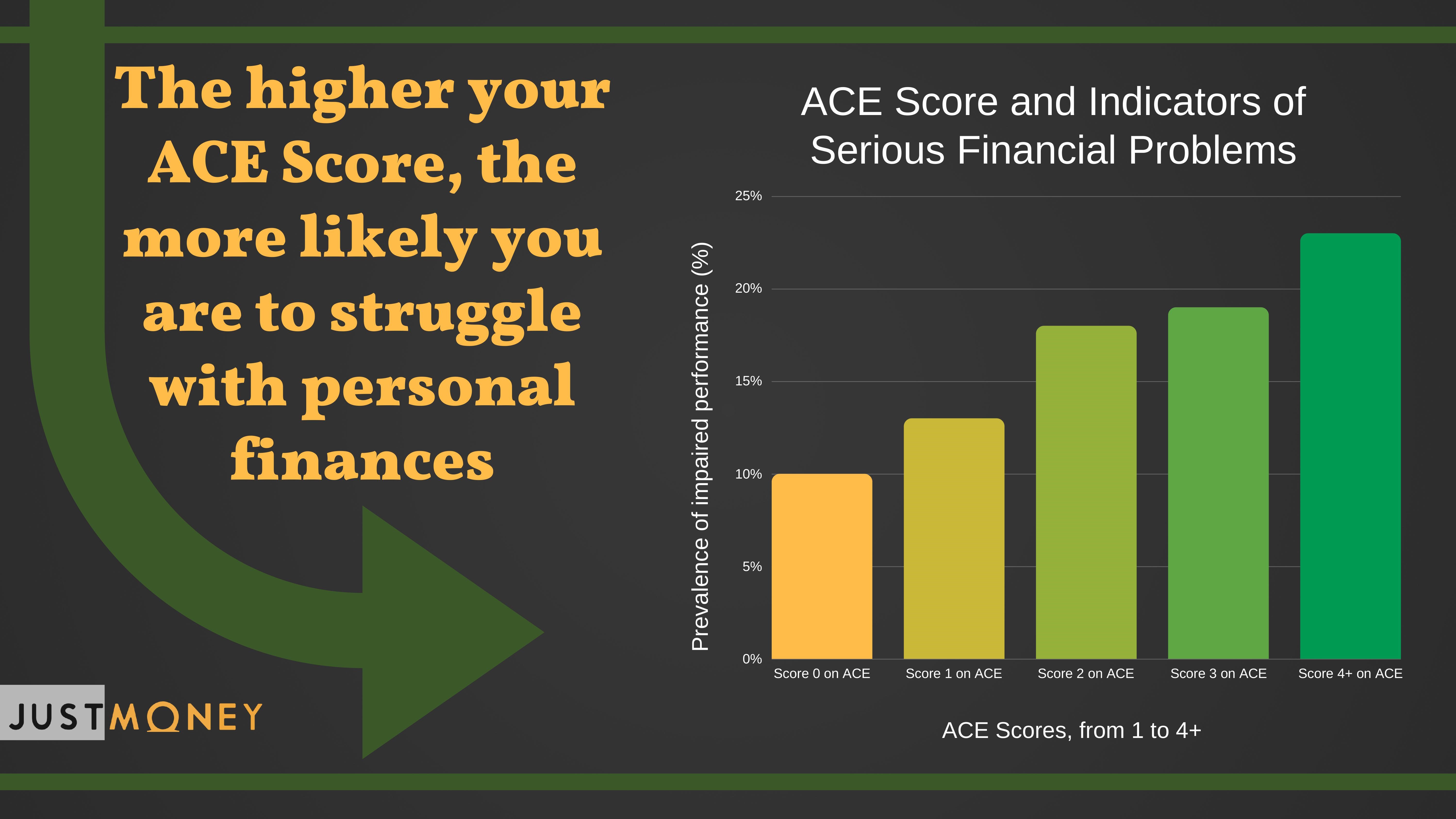

She advises those who are uncertain whether they experience childhood trauma to take the Adverse Childhood Experiences (Ace) Questionnaire. Click here to find out more about it.

Graph: Statistics based on a chapter from The Hidden Epidemic: The Impact of Early Life Trauma on Health and Disease, by Dr Vincent Felitti and Dr Robert Anda, co-founders of the ACE Questionnaire.

Mitchell explains, “People who score highly on that scale are more likely to suffer and be less able to function well in the world without psychological help.”

How can childhood trauma lead to financial instability?

According to Mitchell, trauma can result in chronic health conditions, low self-esteem, feeling undeserving, and being highly sensitive to stress.

“Common cognitive problems include thinking that you have little control, low risk taking as you feel unsafe, or the negative view of the self as bad or undeserving,” she explains.

“This can impede ambition, and if someone suffers from post-traumatic stress disorder (PTSD) or complex PTSD, they may be unable to imagine far into a future,” she adds.

Mitchell asserts that positive side-effects, like strong empathy and compassion, may also have a negative impact on one’s finances.

“Survivors can be generous and therefore may struggle to hold onto financial gains.

“On the other hand, some survivors of early trauma excel in business as they are driven by a compelling need for external affirmation of their worth,” she adds.

Direct financial abuse can also impact children’s perception

Psychologist Anelle Naude-Lester, who once worked with trauma patients through the South African Police Service (Saps), believes abuse and power go hand in hand.

“Any situation where money is used to control and marginalise a person, could play a role in financial mismanagement later in life,” explains Naude-Lester.

“If you grew up in a household where financial abuse was prevalent, it is possible to adopt a similar attitude as an adult,” she adds.

An example of this is when one parent controls the other parent’s salary, claiming it belongs to him or her, with no regard for personal needs or autonomy.

“Growing up in a household with unhealthy role models can influence our frame of reference and perpetuate the cycle.

“One could grow up believing that a wife should hand over her salary to her husband, for instance, having no financial independence as a result. This is common, but often not acknowledged as a form of abuse,” she explains.

According to Naude-Lester, further trauma could include situations where money was used to gain power and manipulate behaviour.

“Childhood sexual abuse often goes along with monetary manipulation, like gifts or money to buy their silence and implied ‘permission’ for the abuse.

“This creates a dysfunctional view of money and power that can have serious implications for one’s relationship with money later in life,” she insists.

What type of financial issues may be developed?

Financial instability can manifest itself in several ways from childhood trauma. Mitchell iterates that people may go into debt because they are intolerant of stressors.

“Similarly, they may fail to pay bills and, as a result, get worse credit scores. They are also unlikely to ask for raises, which leave them earning less.

“Survivors of trauma are more likely to abuse substances, which can lead to further debt, as well as unemployment,” Mitchell maintains.

Naude-Lester points out that money can buy momentary comfort and escape.

“This could make those who suffered trauma particularly vulnerable to credit card debt and buying on store credit, as the immediate effects of the spending is postponed.

“Should a person be triggered by a memory of abuse, there is often a need to escape from the effect of the memory, because it is uncomfortable. Unnecessary spending could provide such an escape,” she explains.

If this sounds like you, what should you do?

Naude-Lester does not believe in viewing yourself as a victim of your childhood. Instead, she believes childhood trauma could serve as an explanation for financial disfunction and be used as a starting point for remedial action.

“Your relationship with money is a real and evolving relationship; like any other in your life. You need to understand it, have insight into your role in this relationship, and be aware of how it impacts on the other significant relationships in your life,” she explains.

Mitchell adds that if the Ace Questionnaire showed that you may suffer from childhood trauma, you should see a counsellor, social worker, psychologist or psychiatrist to work through it.

And once you're ready to sort out your finances, you can complete this form to receive professional advice from a debt counsellor.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.