With South Africa ranking among the countries with the highest tax rates, citizens may wonder what the grass looks like on the other side.

26 April 2018 · Isabelle Coetzee

With South Africa ranking among the countries with the highest tax rates, citizens may wonder what the grass looks like on the other side.

According to Roné Silke, consultant at Sovereign Trust, South African tax rates are high because of shortfalls in tax collection, as well as poor economic growth.

“If economic growth is slow, then both corporations and individuals earn less on which they can be taxed,” explained Silke.

“This is addressed by gradually adjusting tax rates for higher-income earners, who feel the increases less than the lower-income groups,” she added.

Lower taxation used for economic growth

However, some countries rely on lower tax rates to improve their economic growth.

“In some countries, competitive tax rates aim to boost the economy by attracting investment. This provides the opportunity for other types of taxation, such as consumption tax and basic income tax,” said Silke.

She listed countries like the Bahamas, British Virgin Islands, Cayman Islands, Monaco and the Turks and Caicos Islands, where no corporate income taxes are required.

“These jurisdictions regard itself as financial services centres that need to attract foreign businesses, promote tourism, and create residency programs in order to sustain their economies,” she explained.

Silke believes the days are numbered for tax-free regimes because unfair competition has placed pressure on other countries. But for now, they remain.

“In countries, like certain cantons of Switzerland, it is possible for individual tax payers to negotiate their annual tax levies with local tax authorities,” said Silke.

“Other countries, such as Malta, offer a remittance basis of taxation where only 15% of what is remitted to Malta is taxable. In addition, there is no world-wide taxation for residents,” she remarked.

Countries with the highest and lowest tax rates

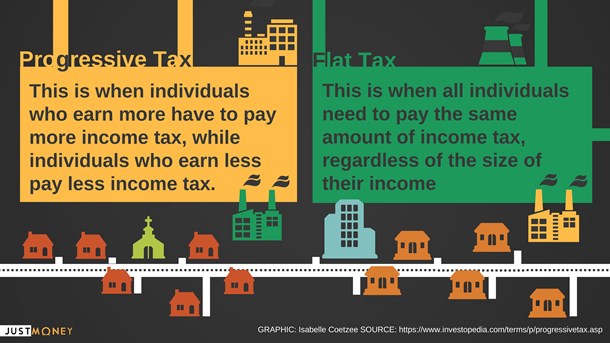

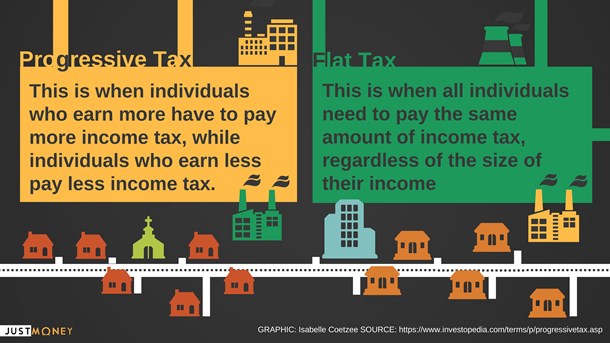

Most countries either have a progressive tax regime or a flat rate tax regime (refer to infographic below), and corporate entities usually have a fixed tax rate.

According to Silke, the following countries have some of the lowest tax rates:

In contrast to this, some countries are known for their relatively high income tax rates – especially European countries and the United Kingdom. Silke explained this is predominantly because these countries need to fund welfare programmes.

She lists the following countries with the highest tax rates:

High taxation for good reason?

“Generally, countries with higher tax rates offer their taxpayers an array of social and other benefits, such as free or reduced tertiary education and state-sponsored retirement benefits,” said Silke.

“However, there has been increasing pressure on South African individuals to fend for themselves and not rely on the state,” said Silke.

She believes South Africa’s high tax rate is often criticised because those paying the most taxes receive little from the state. Unlike more developed countries, they do not benefit from the country’s welfare programmes.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.