25 October 2021

Opening a store account is one of the easiest ways to build your credit score. Not surprisingly, a recent report by the National Credit Regulator (NCR) found store accounts to be among the most popular credit types for South African consumers - ...

15 July 2020

You may find yourself in a financial rut, undergoing debt counselling. While you might consider taking out an additional personal loan – this may not be the answer to your problem. We explore the legalities and whether or not this is an o...

15 January 2019

The rand has started 2019 with a bang and is 3.5% stronger against the US dollar. This is mainly the result of off-shore events, which makes this sentiment driven. And - as we all know - sentiment can change at the drop of a hat.

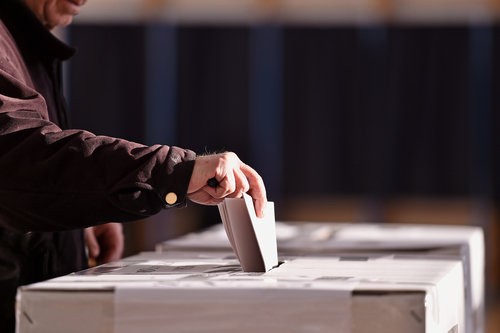

7 November 2018

It would not be surprising if a fair few of us had a bit of nostalgia with the sudden overflow of the word mid-term. Luckily it has nothing to do with late-night cramming for an exam - the key focus this week is the mid-term elections in America.

21 August 2018

Old Mutual recently launched the first corporate waste-to-drinking-water filtration plant in South Africa at Pinelands.

24 July 2018

Too much focus on politics is holding back South Africa’s economy. Kevin Lings, chief economist at Stanlib, said in an interview with Justmoney that investors are reluctant to invest in a country with inconsistent policies.

1 July 2018

Shoprite/Checkers workers have demanded that the company raise their basic income. This is after the National Transport Movement (NTM) accused the Shoprite group of paying some of their employees R400 a week.

27 June 2018

Changes to align medical aid schemes to the proposed National Health Insurance (NHI) were proposed on Thursday by Aaron Motsoaledi, the Minister of Health. The announcement was received with mixed feelings, some claiming the NHI itself was unsus...

17 June 2018

The South African Social Security Agency (Sassa) recently launched a new gold card which boasts not just new features, but benefits as well.

11 June 2018

In response to a call for environment-friendly packaging, a company called Lension SA has ventured into producing biodegradable plastics.

4 June 2018

Divorce rates are the highest among couples who have been married for five to nine years. This is according to data released by Statistics South Africa (StatsSA) on Wednesday.

27 May 2018

In an era where access to housing is limited to a privileged few, a property Stokvel may be the access card that the previously disadvantaged need.

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.