The most used rewards programme in South Africa is the Pick n Pay Smart Shopper card, with the Clicks ClubCard and Woolworths WRewards short on its heels. This is according to the 2018 Loyalty Programme Member Engagement Survey, which is based o...

5 September 2018 · Isabelle Coetzee

The most used rewards programme in South Africa is the Pick n Pay Smart Shopper card, with the Clicks ClubCard and Woolworths WRewards short on its heels.

This is according to the 2018 Loyalty Programme Member Engagement Survey, which is based on answers from 1,413 respondents, predominantly between the ages of 25 and 34.

The survey identified and researched 26 key loyalty programmes in South Africa, ranging from retail banking to lifestyle, leisure, and entertainment.

Of all the programmes, it found that the grocery and health & beauty category has the largest membership base – mostly because shoppers regularly visit these stores.

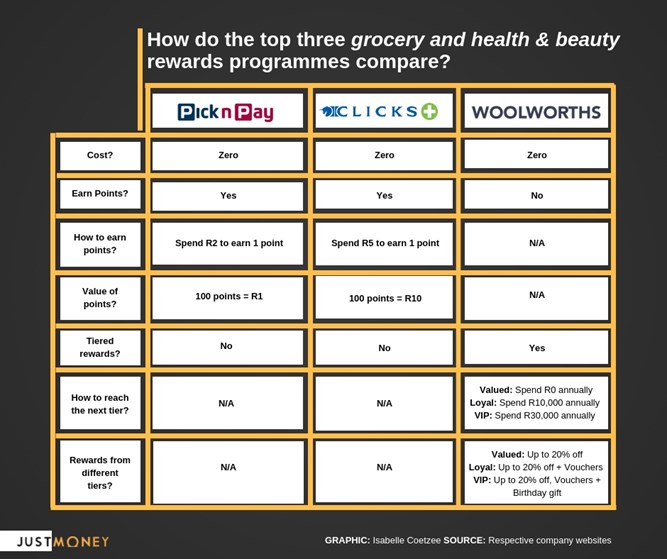

On average, 72% of respondents who are members of these loyalty programmes actively use their cards in-store. Have a look at what the top programmes offer:

Grocery and health & beauty also ranked first in terms of whether respondents would recommend the loyalty programme to their friends and family – retail banking was second.

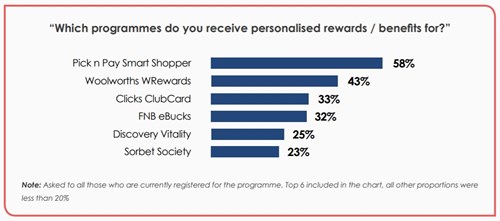

Respondents cited that the three largest rewards programmes were also the top three programmes that offered them personalised rewards and benefits. Refer to the graph below:

According to Heloise Janse Van Rensburg, customer marketing executive at Clicks, its ClubCard rewards customers with points that are earned against their purchases.

“Those points become cashback, and who doesn’t want cashback to help pay towards future purchases?” says Janse Van Rensburg.

She explains that the Clicks ClubCard loyalty programme is one of the oldest retail loyalty programmes, with over 7.5 million active members today.

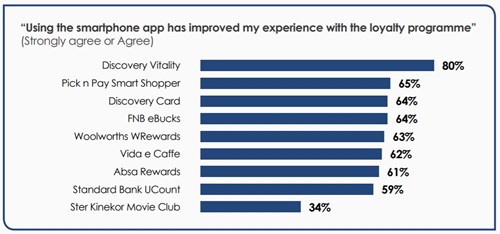

Some companies also link their rewards programmes to an app. The below graph shows which apps have improved customers’ experience with their rewards programmes:

From the Grocery and health & beauty category, the Pick n Pay Smart Shopper ranked second and the Woolworths WRewards ranked fifth.

The Pick n Pay app allows customers with Smart Shopper cards to receive personalised discounts on products they regularly purchase.

They simply need to download the app, connect it to their Smart Shopper card, and they will automatically receive weekly specials specifically aimed at them (find out more).

Similarly, the WRewards app allows customers to access and manage their vouchers, view their balance, and check whether a specific store has the product they are looking for.

It also allows them to view all products on the app and directly create a shopping list, with pictures and prices immediately visible (find out more).

Peter Twine, head of virtual market place and loyalty for Woolworths SA, believes that its instant rewards led to the success of the WRewards programme.

“Besides this, no other loyalty programme gives customers the opportunity to give back via a community loyalty programme, such as MySchool, MyVillage, and MyPlanet,” says Twine.

He explains that these programmes have given back over R570 million since its inception.

“Every loyalty programme aspires to engage its customer base and become more relevant and personalised over time,” says Twine.

He believes companies need to be relevant and they need their customers to constantly experience value when they swipe their cards.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.