We outline South Africa’s cheapest bank accounts, in various income categories.

12 March 2024 · Fiona Zerbst

Bank charges in South Africa are often considered high compared to those in other countries. This prompts consumers to seek cost-effective options.

We reveal the cheapest bank accounts for various income categories.

Tip: Use a savings calculator to determine how long it will take you to reach your savings goals.

The Solidarity Bank Charges Report 2024 identifies the FNB Easy PAYU as the cheapest low-income bank account in South Africa.

The report, authored by Solidarity economic researcher Theuns du Buisson, provides a comparative analysis of the cost of personal transaction accounts at five South African banks, including Bank Zero and TymeBank, which are covered in the online banking services category.

The report compares the costs of transaction accounts; that is, accounts that cover complete banking services and are available to any member of the public.

Accounts that specifically target students, youth, the elderly, and other niche categories are not included. The report makes it clear that consumers’ needs differ, and that specific transactions can change an individual’s experience of a bank’s cost structure.

There are four categories included in the report, as follows:

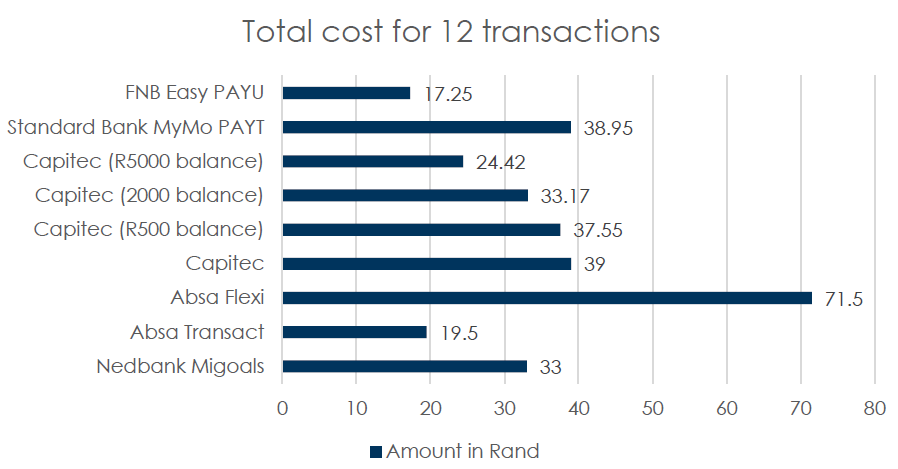

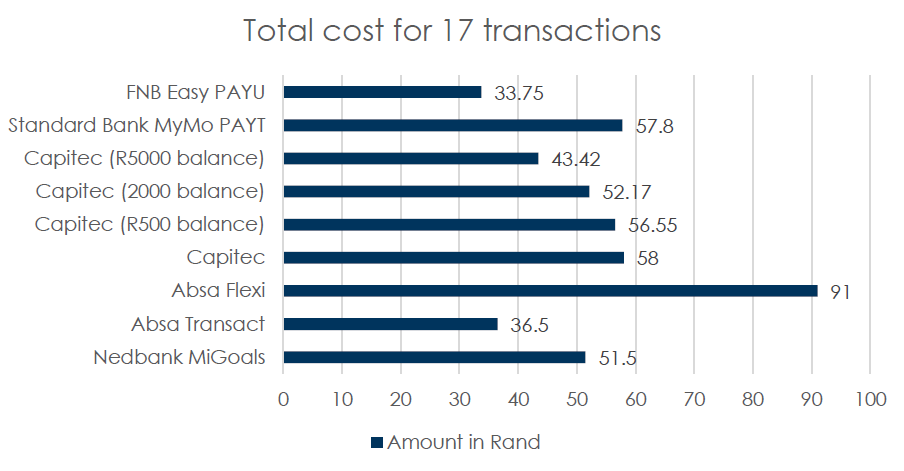

In the low-income category, the FNB Easy PAYU account is the cheapest, offering options for 12 and 17 transactions a month. What makes this account stand out is the number of free transactions included in the R5.25 monthly fee, according to Du Buisson.

This is the only account in this category that offers free airtime purchases. FNB also offers free cash withdrawals at shop counters.

Absa’s Transact Account is the second-cheapest account in the low-income 12- and 17-transaction category. This account allows you one free transfer of money to a cell phone number a month, and free cash withdrawals from shop counters.

The Absa Transact Account is only available to people earning less than R3,000 a month, and is upgraded to the Flexi Account once you earn more.

Source: The Solidarity Bank Charges Report 2024

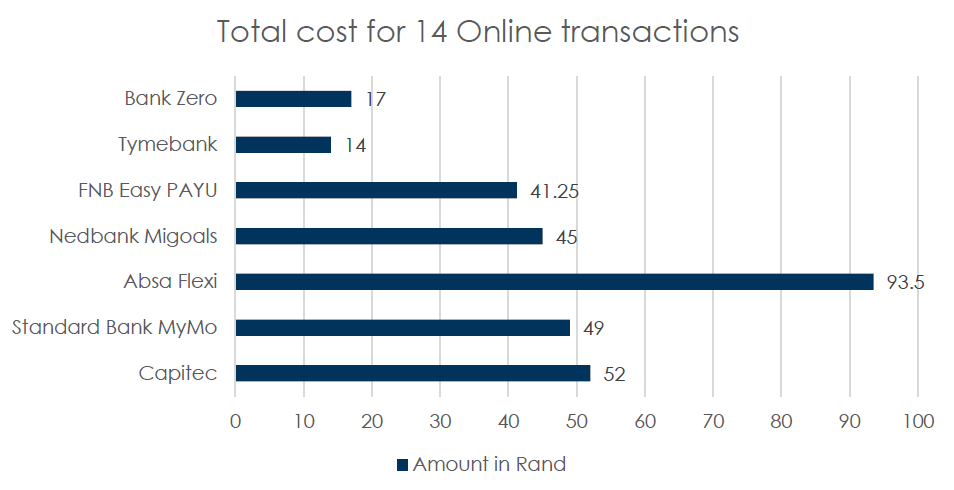

TymeBank emerged as the cheapest online bank with the lowest fees at R14 a month, followed by Bank Zero with a fee of R17 a month.

Du Buisson says that, regardless of how this category is marketed, the only factor used to determine the “winner” is the number of transactions that carry no cost.

“The costs charged by both TymeBank and Bank Zero for 14 monthly transactions are considerably cheaper than the R41.25 set by FNB [for online transactions] – the closest competition among the traditional banks in South Africa,” he notes.

Digital banks are ideal if you don’t require extensive banking services or physical branches.

Source: The Solidarity Bank Charges Report 2024

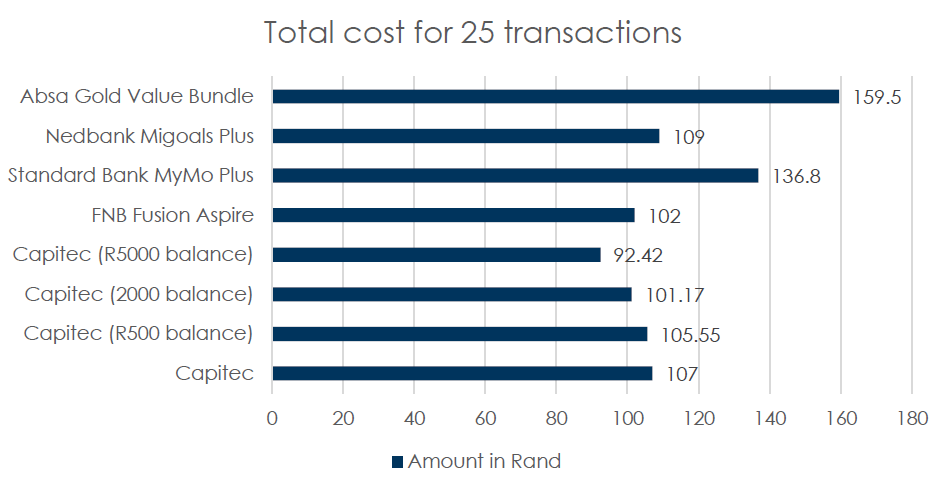

In the middle-income category, the cheapest account is the FNB Fusion Aspire option, which charges R102 a month. This includes all of the transactions in Solidarity’s basket (the most common transactions, excluding other fees such as immediate payment or Saswitch fees), except electricity purchases.

Capitec would have taken the top spot based solely on cost, assuming consumers have a balance in their transaction accounts that would earn interest for at least some of the month. However, Capitec cannot compete in this category as it lacks extra-value offerings, such as an extensive rewards programme, says Du Buisson.

With Capitec excluded, Nedbank’s MiGoals Plus takes second place with a monthly fee of R109, which includes all transactions in Solidarity’s basket.

Source: The Solidarity Bank Charges Report 2024

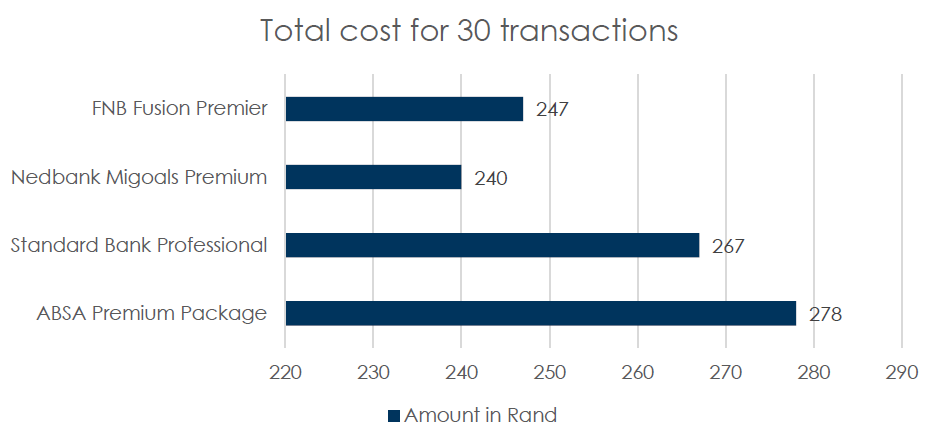

In the higher middle-income offering of 30 monthly transactions, Nedbank’s MiGoals Premium account comes out cheapest at R240, with FNB’s Fusion Premier account in second position at R247.

Customers in this category have more sophisticated banking needs and focus more on added value and rewards programmes than cost alone.

“The number of free transactions included in the monthly fees determines the most competitive accounts in this category,” notes Du Buisson.

Source: The Solidarity Bank Charges Report 2024

Tip: Does debt leave you without enough money to get through the month? Find out if you qualify for debt consolidation.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.