Saving is a crucial step towards securing your financial future. We consider which South African bank accounts best help you to save.

7 November 2023 · Fiona Zerbst

Having savings allows you to plan for the future, and banks offer a variety of accounts specifically for stashing your savings away.

However, not all accounts are of equal value; some help your money work harder for you than others. We investigate which savings accounts offer the best returns.

Tip: Learn more about the value of saving and investing for your future.

Whether you’re employed or retired, you’re probably feeling cash-strapped, given South Africa’s current economic environment. If you have money saved, you must ensure it works hard for you.

Banks will pay you interest when you deposit money with them. However, different banks pay different rates, depending on various factors, including age (some banks offer a higher rate to customers aged 55 years or above) and the amount you deposit.

For comparison, the rates quoted in the tables below are nominal – i.e., before inflation is considered. However, be aware that banks don’t always advertise nominal rates. Some may quote the “real” interest rate – or the rate you can expect to receive after inflation is taken into account. Nominal and real rates can differ by up to 3%, so it’s vital to ask your bank which of these the advertised rate represents.

It’s also important to note that the quoted interest rates may be subject to change over time, so be sure to check with the bank.

The tables below provide an overview of savings accounts in South Africa. However, the account offering the best interest rate will vary widely depending on how much money you have and can save.

The South African Reserve Bank (SARB) sets the repurchase or “repo” rate – the rate at which commercial banks can borrow from SARB.

The prime interest rate is the rate at which banks lend to borrowers. This will always be higher than the repo rate so the banks can make a margin on the transaction.

To be more competitive, some banks offer higher interest rates to savers. As little as 2% additional interest can make a significant difference over time, notes Dawie Roodt, founder and chief economist of the Efficient Group.

By way of example, if you deposit R20,000 in a savings account that offers 6% interest annually, and you deposit R20,000 in another savings account offering 8% a year on the same terms, you’ll receive interest of R100 on the 6% account and R133 on the 8% account.

This interest will be capitalised every month, which means it will be added to the balance.

“After ten years, the first account will have a total of R36,000 in it, while the second will have R44,000 in it – that’s a difference of almost R8,000 after 10 years,” notes Roodt. “After 20 years, the difference will be even more pronounced, with the first account yielding R66,000 and the second R98,000.”

The additional R32,000 illustrates the power of compound interest over time.

A high-interest or high-yield savings account provides a high rate of return when compared to regular savings accounts. These accounts can help you grow your wealth more rapidly, but be mindful that they also attract higher withdrawal and maintenance fees.

Some accounts tier your interest rate according to your balance amount, which means the more you save, the more you earn.

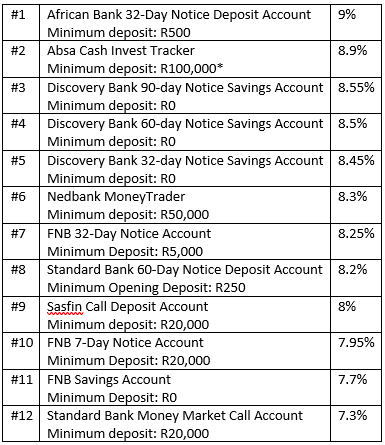

The best interest rate on a savings account for an investment of R50,000 in South Africa is African Bank’s 32-Day Notice Account. It offers up to 9% interest once this amount has accumulated in the account; however, only R500 is required as a minimum deposit, in order to open the account.

Similarly, in the additional accounts shown in the table below, the minimum deposit opens the account, but the cumulative total must be R50,000 or more, to attract the interest rate shown.

*Note: Although the Absa Cash Invest Tracker requires a minimum opening balance of R100,000, the interest rate of 8.9% applies irrespective of withdrawals, and current balance amount.

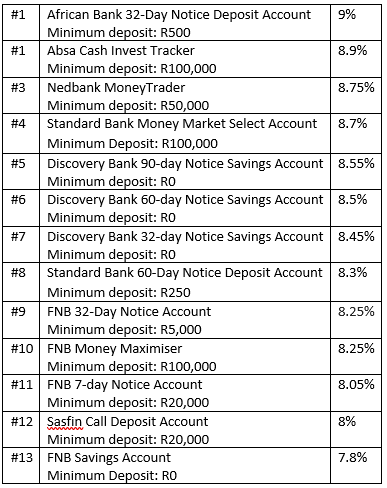

The best interest rate on a savings account for an investment of R250,000 in South Africa is African Bank’s 32-Day Notice Deposit Account. It offers up to 9% interest and requires a minimum deposit of R500.

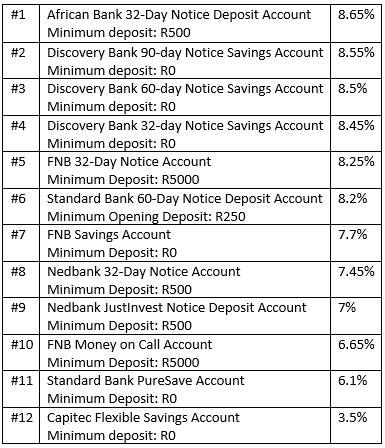

The African Bank 32-Day Notice Deposit Account comes out as the top savings account in the R5,000 investment category.

Some savings accounts are more effective at helping you achieve your savings goals. It’s important to consider your timelines – are you saving for a holiday in December, or a deposit for a home? Also bear in mind your liquidity needs (whether you’ll need to access the funds at short notice).

Below are some options to consider.

Traditional savings accounts combine low-risk saving with easy access to your money. However, interest rates on basic savings accounts can be on the lower side.

Fixed deposit accounts typically offer higher interest rates than traditional savings products. However, your money will be locked in for anything from one month to five years. You may face penalties for early withdrawal.

Money market accounts offer competitive interest rates. These are a good option if you want higher returns but still need an accessible, or “liquid”, account.

Tax-free savings accounts (TFSAs) offer tax-free growth but attract annual and lifetime contribution limits. For this reason, you can’t replace any savings you withdraw.

By way of example, if you contribute R36,000 in one year but withdraw R10,000, the amount you have withdrawn will contribute to your annual contribution limit, leaving you with only R26,000 in tax-free savings for that year.

Additionally, your total lifetime limit will be R490,000, as the R10,000 will still be counted as a contribution.

Tip: Is debt preventing you from saving enough for retirement? Find out how debt consolidation can help.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.