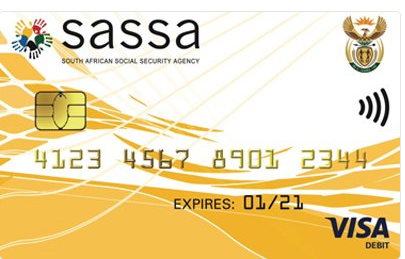

The South African Social Security Agency (Sassa) recently launched a new gold card which boasts not just new features, but benefits as well.

17 June 2018 · Athenkosi Sawutana

The South African Social Security Agency (Sassa) recently launched a new gold card which boasts not just new features, but benefits as well.

Beneficiaries will not be able to use their old card after 30 September, said Nandi Mosia, the agency’s spokesperson.

With the gold card, beneficiaries can swipe for free, expect one free ATM balance; three free withdrawals per month at retail stores and one free cash withdrawal at South African Post Office (Sapo) branches.

In the past, beneficiaries complained about illegal airtime and electricity deductions from their social grants.

“With the new card there won’t be such deductions - it will only be social grant payments,” said Mosia.

The Constitutional Court mandated Sassa to stop using Cash Paymaster Services (CPS). This is after the court declared the contract with the payment services provider as illegal.

The agency has since entered into a new contract with the South African Post Office (Sapo). In a statement issued in May, the agency said one of its goals was to reduce the number of beneficiaries collecting their grants at cash points.

Grant recipients can access their funds through the Post Office, personal bank accounts, various ATMs or retail stores.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.