Collecting your friends’ debt to you can be draining. You don’t want to ruin your friendship with them, and it can also be extremely awkward. I don’t know how many times I have written, deleted, and rephrased texts, remindin...

9 June 2019 · Athenkosi Sawutana

Collecting your friends’ debt to you can be draining. You don’t want to ruin your friendship with them, and it can also be extremely awkward. I don’t know how many times I have written, deleted, and rephrased texts, reminding people to pay what is due to me.

Thanks to the advancement of technology, we can now use apps to help us give those people a nudge.

Before Splitwise I was happily using Who Owes Me, a helpful debt management app, to help me remember who I owe and who owes me anything – from a favour to money. Then my favourite magazine recommended Splitwise, and I decided to give it a try.

The app lets you share expenses with your friends, family, or even flatmates. You can split the bill equally amongst each other.

Creating your profile

When creating a Splitwise account you will be required to enter important details such as your email and your phone number. You will then change your currency if you’re not using dollars to your local currency.

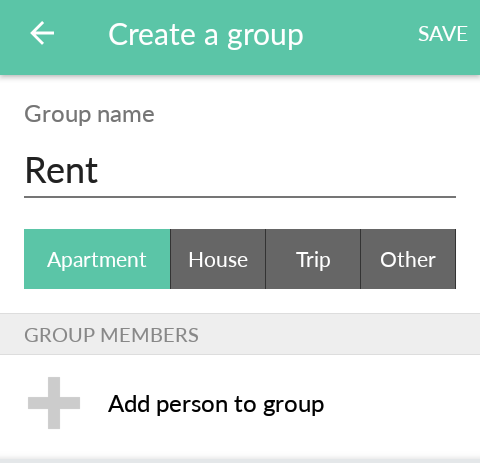

You can then create a group, give it a name, and add the people you want to split your expenses with. I have three groups; one of them is called “Rent”. It is probably the most active one, because I share rent with my flatmate.

There are categories of groups you can choose from, such as apartment, house, and trip. You can choose others if you want to create your own category. You can add as many people as you want and the app will tally the bill and divide it equally amongst you.

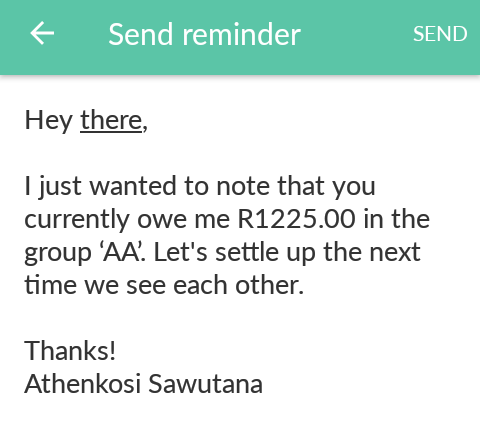

The app will request the person’s number and email address to help you send notifications to your debtors about the amount they owe you.

The app also helps you send a friendly reminder to those you share the bill with, and you can update it on the app when the bill has been settled.

Notable features on Splitwise

One feature, called the whiteboard, allows you to remember important information such as your landlord’s phone numbers and address. Splitwise also lets you export the information to a spreadsheet.

I was happy to learn that the app keeps a record of your activity and the dates they were performed on. This makes tracking easy.

If you turn on your notifications the app will notify you when the members of the group pay up or when the expenses are edited or deleted.

It would be even better if the app was connected to payment services such as Paypal which would allow you to link your card to the app for easy transactions.

The app does not only help you get the money owed to you, but it also reminds you to pay your own debt.

The fact that I don’t pay for these services is a bonus for me. Even better, this app has no unsolicited ads as was the case with my previous app.

Splitwise is definitely worth the try, especially for those who constantly have to share bills. For instance, when you go out with friends and order drinks or Uber, you can pay and send these bills in the morning after a good night’s rest.

It is a fantastic app to have, especially for those friends who suffer from amnesia when it’s time to pay back.

For more tools that can help you manage your money better, check out our budget and savings calculators.

Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.