1 July marked the official opening of Tax Season 2018. If you’re a first-time tax filer this may seem daunting - from which paperwork to fill out, to submission dates and accompanying documentation. For this reason, many people opt to make use of tax services to file their returns at a service charge. While the argument may be that they’re paying for convenience, is it really worth the extra fee?

“Practitioners will generally charge anywhere upwards of R800 with some larger firms reaching costs of R2500 or more. It would depend on the complexity of the return itself,” says TaxTim’s marketing strategist, Patrick Knight.

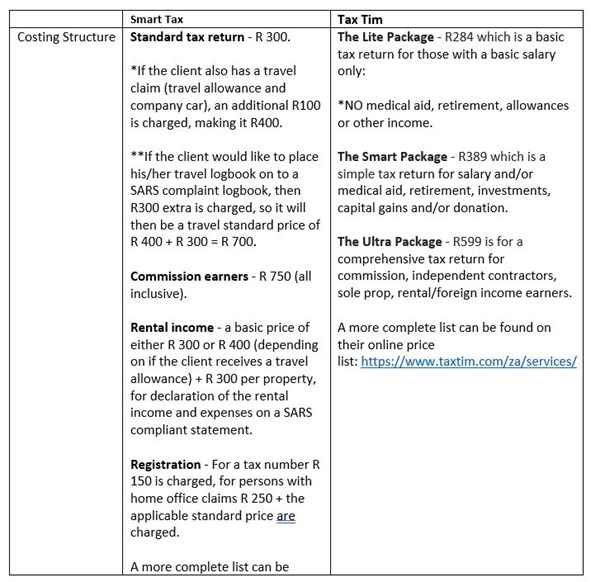

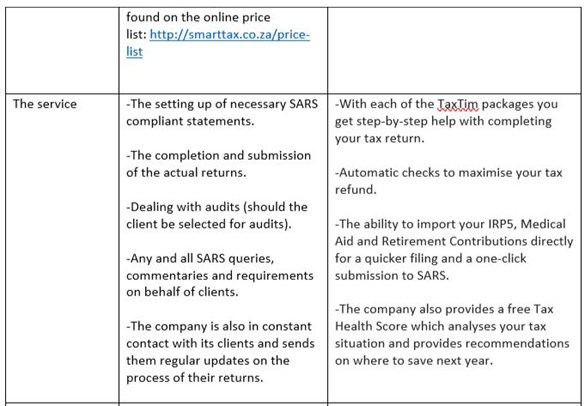

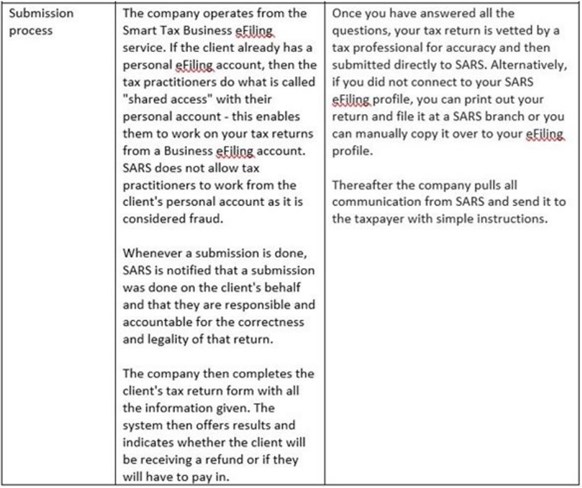

While tax service companies are a dime a dozen, Justmoney has decided to zoom in on two tax services, Smart Tax and Tax Tim, to compare their offerings and fees.

Tip: To learn more about tax-free savings accounts and which offer the best value, click here.

The aspects we chose to compare were costing structure, the service, submission process, turn- around time, refund process and additional features.

While it is hard to compare the two services on a like-for-like basis as it is dependent on a number of factors like the details and nature of your tax submission, their basic services are the same. TaxTim’s R284 Lite package seems to just undercut Smart Tax’s R300 Standard plan by R16. The same trend seems to be the case throughout the two services’ costing structures, with TaxTim coming in as cheaper.

Do it yourself

So now that the professionals have weighed in and made their price, let’s look at the DIY option. Would the money you will potentially be saving be worth it?

As everything is done on The South African Revenue Services (SARS) eFiling portal, this is your first point of call, granted you already have your tax number.

To begin the DIY process of filing your own tax returns you need to start by registering.

This process requires you to: Visit http://www.sarsefiling.co.za, select the register button on the left-hand side and select the registration type that applies to you. According to the website, once you have completed the registration details, you will be sent an email with an attached form. This needs to be completed and faxed to SARS along with a copy of your ID. Once received, SARS will issue you with an access number, which will be required for your first login.

Then, when it is time to complete your tax return, you can log into your eFiling profile and complete the simple process online.

How much will it cost?

According to SARS its service will cost you absolutely nothing. Your bank however will still charge you the normal fee for transactions should you make use of the SARS payment options to settle your tax liabilities.

While this may sound like a walk in the park, navigating the eFiling system - especially for a first-time user - can be tricky. Alternatively, you could visit your SARS office during tax season and an official will help you to complete your return. Be sure to take all the necessary documentation with you. This documentation according to the SARS website usually consists of IRP5/IT3(a) Employees Tax Certificate (if applicable), certificates received for local interest income, foreign interest income and foreign dividend income, documents relating to medical expenditure, the income tax certificate(s) received from the financial institution to which contributions for retirement annuities were made and any documentation related to income activities.

Filing your own tax return is definitely the cheaper route, but it also means accepting responsibility for any incorrect details and then corresponding with SARS to fix it (which could take months.).

Further, tax experts advise that if you own a rental property, are a freelancer or have your own business, you may want to enlist a tax service to do the job for you as these returns are typically far more complicated to file.

At the end of the day, it boils down to which is the bigger priority - the convenience of using a tax service or being able to save a few hundred by doing it yourself?

For any assistance visit the SARS website to find your nearest contact centre or call 0800 00 7277.

If you have a retirement annuity and would like to find out how it is being taxed, click here.