Need a cash boost to cover unexpected costs or fund your dreams? A personal loan from a trusted JustMoney partner may be the solution. You could qualify for a Sanlam loan of up to R350,000 or a Capfin loan of up to R50,000.

Apply for a personal loan and other types of credit

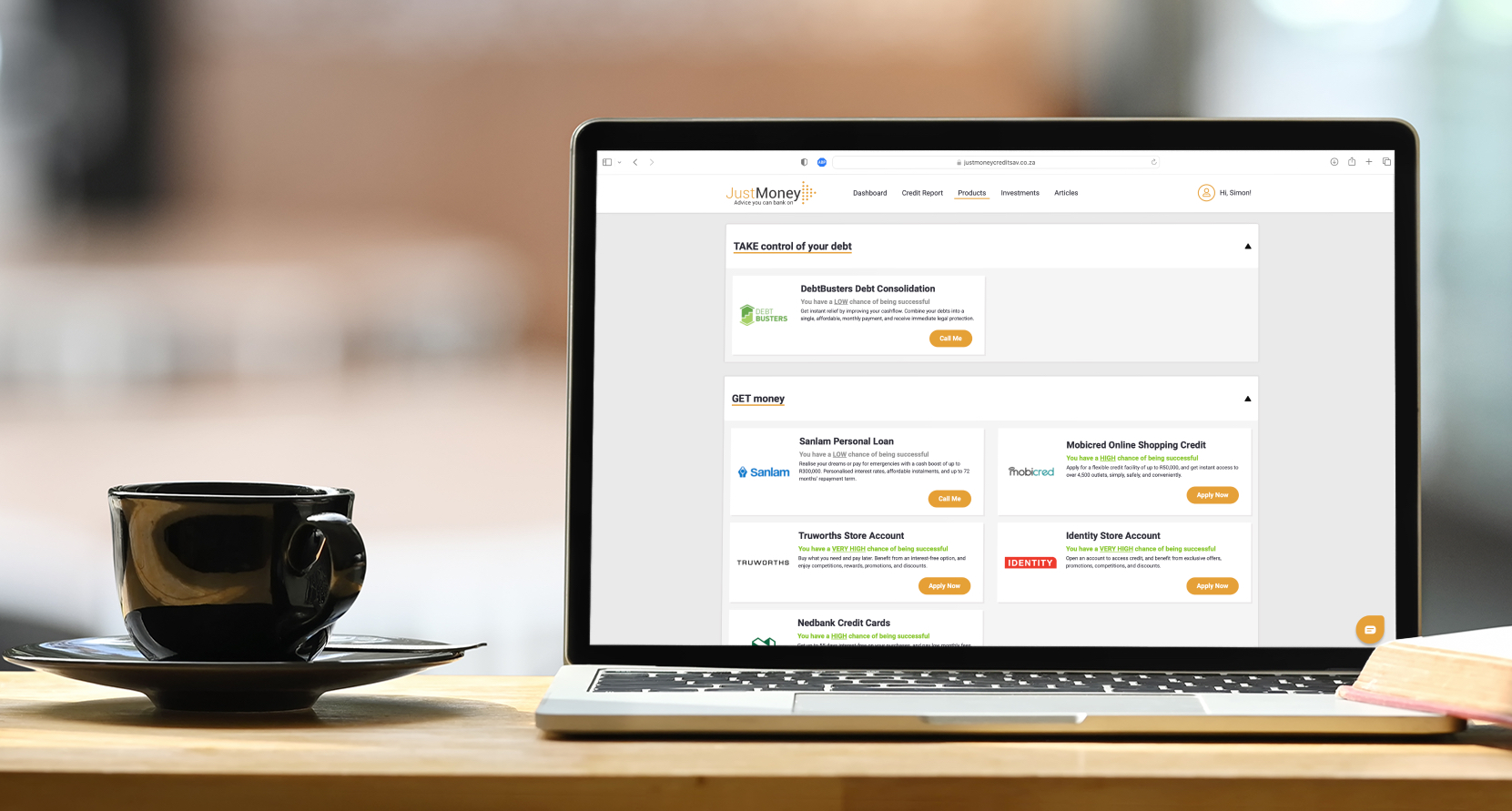

Log in to JustMoney, go to your Solutions page, scroll down to “GET money”, and click the “View Offer” (Sanlam) or “Apply Now” (Capfin) buttons to see your free personal loan quote. We’ll provide instant feedback based on your affordability and credit score. You can also apply for online shopping credit with Mobicred, an Identity store account, and a Nedbank credit card.

How personal loans work

What are personal loans?

Personal loans are unsecured loans that provide a lump sum of money for you to use for anything from medical emergencies to home upgrades.

With flexible repayment terms and competitive interest rates, personal loans offer a convenient way to manage your finances wisely.

Here’s what you can expect from a personal loan through JustMoney:

- Capfin loans: 5% to 28.5% interest rate, depending on your credit score and affordability; six to 12 months’ repayment term.

- Sanlam loans: 16% to 28.5% interest rate, depending on your credit score and affordability; up to 84 months’ repayment term.

How to apply for a personal loan

- Sign up: Register on the JustMoney platform to apply.

- Apply online: Complete an easy application form in minutes.

- Get your application result: Our trusted partners will review your information and let you know if you’re approved – usually within a few days.

- Receive your funds: Once approved, the money will be transferred into your bank account.

Why apply for a loan with JustMoney’s partners?

Reputable financial institutions

At JustMoney, we partner with trusted lenders to offer personal loans tailored to your needs and budget.

Our platform provides an instant indication of how likely it is that you will qualify for a loan. This helps you make good money choices upfront.

Competitive interest rates

Our partners offer interest rates designed to be competitive, helping you reduce the total amount you repay over the loan term.

Flexible repayment options

Whether you’re able to pay back your loan quickly or need more time, you’ll find options that work for you.

Transparent terms

At JustMoney, there are no hidden fees. We explain everything upfront, so you know exactly what you’re signing up for.

Borrowing is now faster, simpler, and more convenient.

Credit score insights

When you apply for a personal loan through JustMoney, you’ll see your credit score upfront – along with insights into how it affects your chances of getting approved.

We help you understand how your credit profile influences the loan offers you receive, so you can make informed borrowing decisions.

This allows you to stay in control of your financial future.

What you need to apply for a personal loan

To apply for a personal loan via JustMoney, you must be:

- At least 18 years old

- Permanently employed, with three months’ payslips or bank statements as proof of income

- A South African citizen or permanent resident with a valid ID document or smart ID card

If you apply for a personal loan, JustMoney’s partners will conduct an affordability assessment to ensure you can manage the monthly repayments.

A healthy credit record stands you in good stead when applying for a loan.

Quick guide to personal loans

Personal loans are among the most accessible forms of credit available to South Africans. Here are some costs a loan can help you with, so you can better meet your financial goals:

Education expenses

Tertiary education is a form of good debt – a personal loan can help you study towards fulfilling your career aspirations and improving your earning capacity.

Debt consolidation

A debt consolidation loan can help ease stress and avoid missed payments by combining multiple debts into one monthly repayment and providing a clearer picture of what you owe.

Medical bills

Even if you have savings or medical aid cover, high medical bills could catch you off guard. A personal loan can help cover unexpected costs.

Home renovations or repairs

Repairs or upgrades to your property can make it more valuable. A personal loan can help fund necessary home improvements.

Funeral costs

Funerals can come with unexpected costs, and in some cases, funeral policies may not cover everything. A personal loan can help bridge the gap, allowing you to give your loved one a dignified farewell.

Emergency costs

A personal loan can provide quick access to cash for urgent costs, such as car or appliance repairs.

Where to find more information

JustMoney has a wealth of information on personal loans and other aspects of personal finance.

What people say

Articles and insights

JustMoney’s articles and insights help you learn more about personal finance. We explain difficult concepts in simple terms and help you make good money choices.

Are personal loans tax deductible in South Africa?

20 March 2025 · Fiona Zerbst

Find out if personal loans are tax deductible in South Africa, and explore tax regulations, business loan tax deductions, and tax-planning strategies.

How to find the best personal loan for you

2 April 2023 · Helen Ueckermann

Personal loans are not created equal, and the loan amount, while important, is not the only criterion you should consider.

Is a personal loan a wise way to cover medical expenses?

17 July 2022 · Fiona Zerbst

Healthcare is becoming increasingly expensive in South Africa. We consider whether a personal loan can be used to cover shortfalls.

Why take out a personal loan?

14 July 2022 · Carlene Gardiner

We consider three ways in which personal loans can be used to your benefit, and whether this form of credit is something you should pursue.

Can you afford the loan you qualify for?

13 April 2022 · Staff Writer

You’ve applied for a loan, and you find that you qualify – but can you afford it? The distinction may not have occurred to you, but it’s important to consider it before putting pen to paper.

Know the difference between a loan and a credit facility

7 November 2021 · Athenkosi Sawutana

Credit options can be separated into loans and credit facilities. We asked about the differences between them.

What are the interest rates on store accounts?

25 October 2021 · Staff Writer

Opening a store account is one of the easiest ways to build your credit score. Not surprisingly, a recent report by the National Credit Regulator (NCR) found store accounts to be among the most popular credit types for South African consumers - ...

How to fund a prototype for your start-up

21 October 2021 · Harper Banks

It’s quite an adventure to quit your job start your own business. But this decision also comes with a lot of risk. If the concept is new, it’s best to design a prototype before you jump into the deep end.

Is it worth the penalty to settle your personal loan early?

28 September 2021 · Harper Banks

If you have a personal loan, and you just received a bonus or an inheritance, you may be considering settling your loan in one go. However, did you know that this comes with penalties?

Videos

Looking to better understand how to take control of your money? Our videos explain personal finance topics clearly and without jargon. If you’re looking for smart tips from experts, our content has you covered.

What does credit wellness mean to you?

Credit wellness is an important indicator of your financial health and journey. We chatted to a few people about their understanding of credit wellness.

31 Top tips to financially survive the silly season

Financially surviving the silly season isn’t always the easiest task, but this year we have you covered. With 31 tips that stretch from budgeting to becoming debt-free, we are here to help ensure that you stay on track.

What scares you about your finances?

Finances can be anxiety-inducing. If money matters keep you up at night or make your brow sweat, know that you are not alone. We spoke to readers about their fears.

Apply now

A personal loan can help you make good money choices on your journey to financial freedom. Log in and view your personalised quote for FREE. You could borrow up to R350,000.