Your risk tolerance helps determine your investment strategy – but how do you find the right balance between risk and reward? We investigate.

28 December 2023 · Fiona Zerbst

Investing is inherently risky because returns are never guaranteed. However, the point at which risk becomes unacceptable varies between investors.

We explore the effect of risk tolerance on investing, and provide tips for gauging yours.

Tip: Long-term investment can provide you with an income in retirement.

Risk tolerance refers to how able or willing an investor may be to endure changes in the value of their investments without feeling uncomfortable or making rash decisions, says Sharon Moller, a financial coach at Old Mutual Wealth.

“It’s a crucial aspect of investing because it helps people find the right balance between risk and reward,” she explains.

“Some people are happy to ride the ups and downs of investments, while others prefer less excitement – but risk-averse investors may miss out on opportunities for higher returns.”

Investors are typically on a spectrum from conservative to aggressive, says Roné Swanepoel, business development manager at Morningstar Investment Management.

Conservative investors worry about short-term losses, or may be too close to retirement to invest over the long term.

“These investors are willing to accept lower returns to help achieve the primary goal of keeping their investments safe,” says Swanepoel.

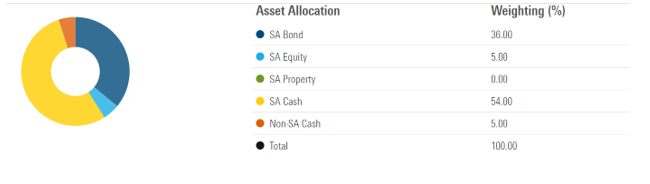

Below is an example of an asset allocation for a conservative investor in a pension portfolio.

Source: Morningstar Investment Asset Management

For a moderately aggressive investor, the primary aim is to increase the value of their investment.

“These investors are willing to accept the risk of losing money and will leave their funds invested even if the value of their investment falls,” says Swanepoel. “They know they can recover their losses and achieve their long-term investment aims.”

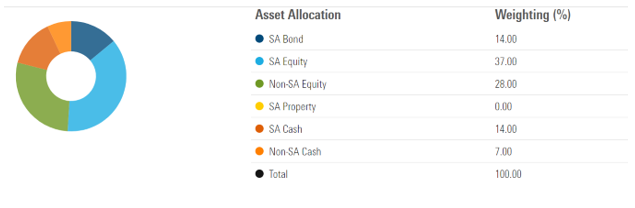

Below is an example of an asset allocation for a moderately aggressive investor in a pension portfolio.

Source: Morningstar Investment Asset Management

Kurhula Baloyi, founder and CEO of Sum1 Investments, a company that provides short-term investments for stokvels and savings groups, notes that it’s important to understand your risk appetite before you invest.

“If you agree to ride a roller coaster, you can’t get off mid-ride,” she points out.

Investors with a high tolerance to risk tend to invest in unconventional assets, such as cryptocurrencies, commodities, high-risk equities, and instruments such as contracts for difference (CFDs), with the expectation of higher returns for the additional layer of risk.

“At Sum1 Investments, members can invest in alternative assets such as livestock or delivery bikes,” Baloyi explains.

“More conservative investors gravitate towards government bonds, index-tracking funds, and money market investments.”

She says there is no one-size-fits-all solution, but investments should be tailor-made for each investor and reassessed as their circumstances change.

To understand your risk tolerance, Moller recommends asking yourself the following questions:

Baloyi says a good rule of thumb is to make sure an investment loss won’t put your goals at risk; for example, your ability to pay school fees. A helpful question is, “Will there be time for me to recover financially if I try a riskier strategy and it fails?”

Tip: Is debt preventing you from investing in your future? Consider debt consolidation.

Free tool

info@justmoney.co.za

5th Floor, 11 Adderley Street, Cape Town, 8001

© Copyright 2009 - 2024

Terms & Conditions

·

Privacy Policy

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.